Technical Insight

European start-ups take components further (Fiber-Optic Components)

The demand for advanced fiber-optic components has resulted in the formation of a number of European companies that are manufacturing products such as VCSELs, 40 Gbit/s devices and hybrid assemblies. Bridget Adams reports.

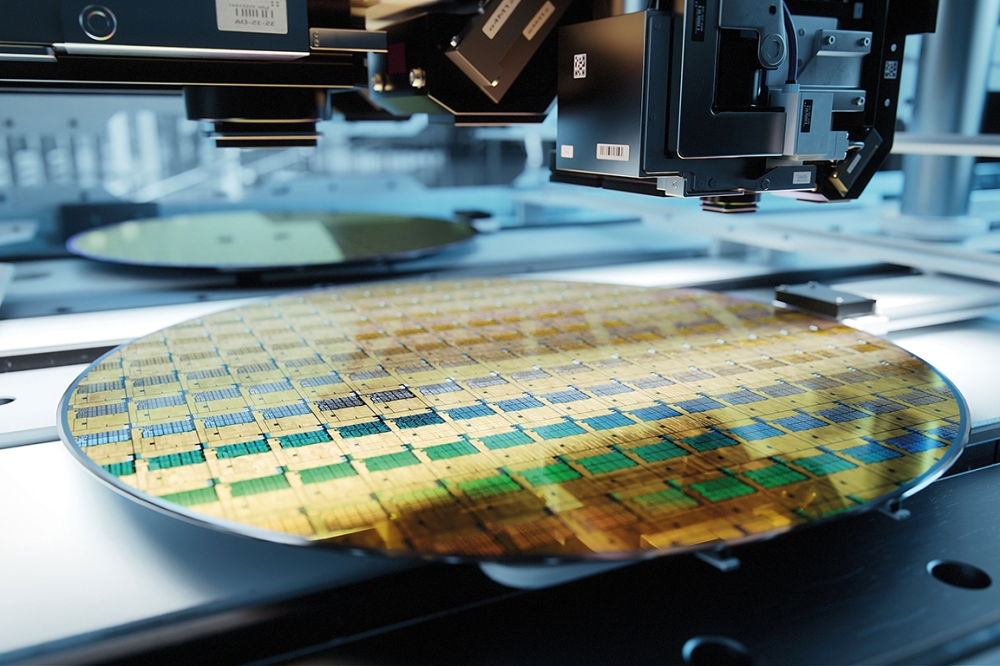

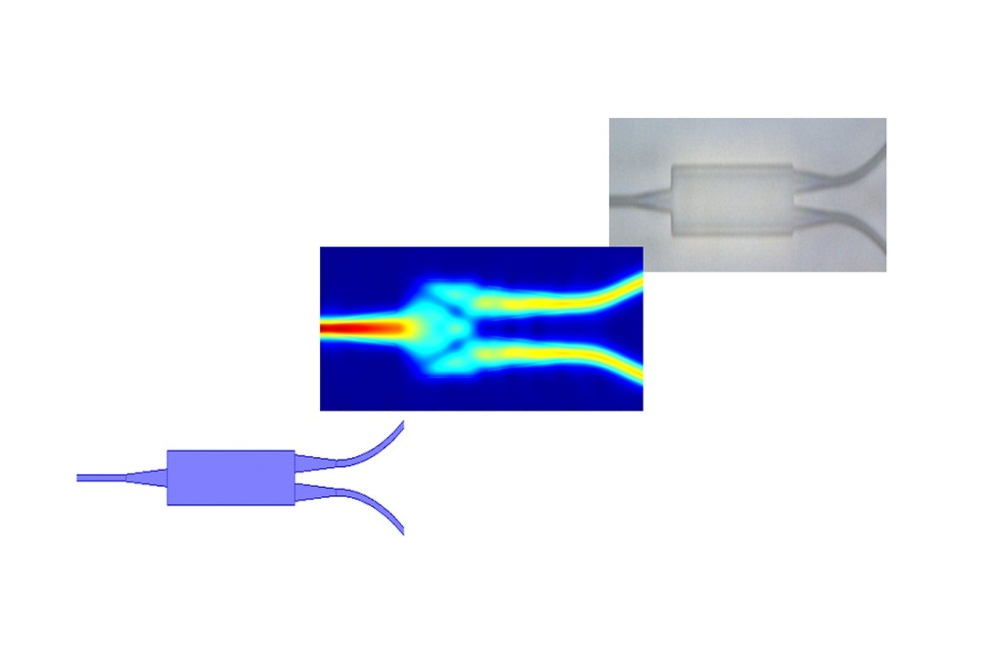

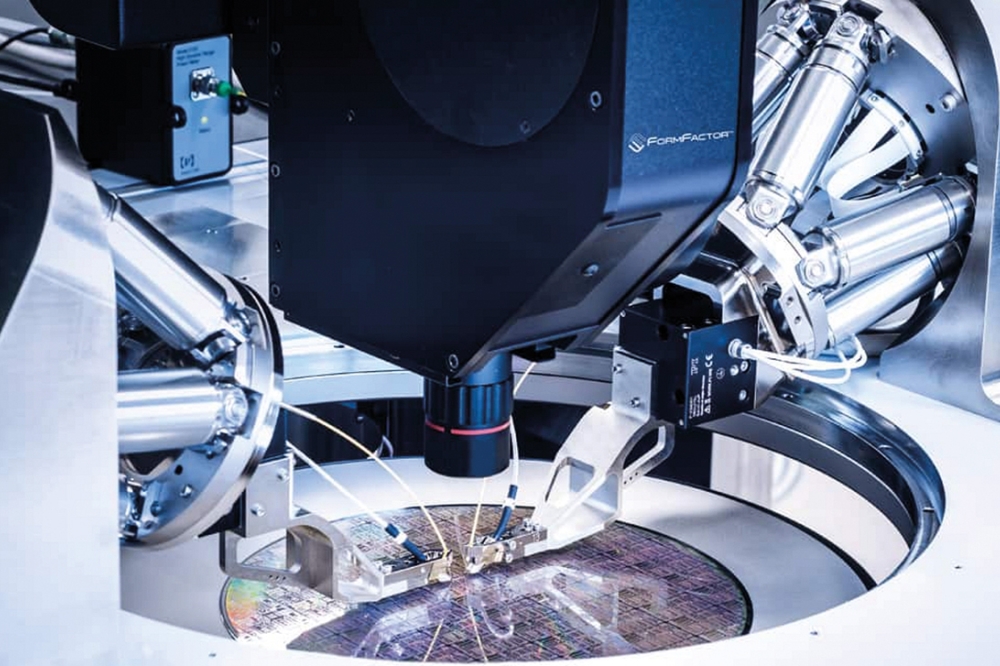

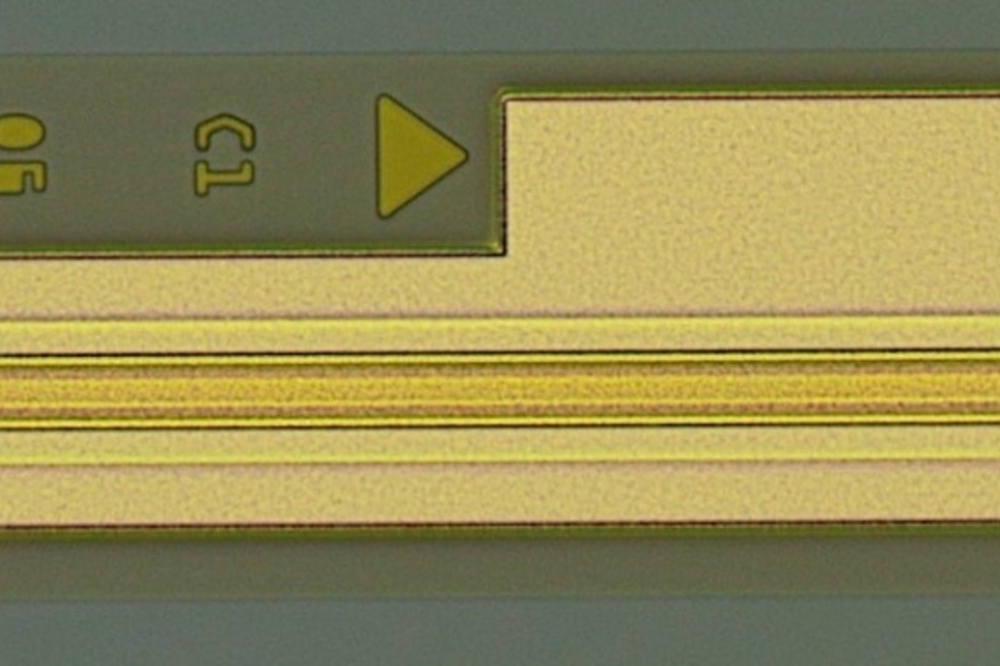

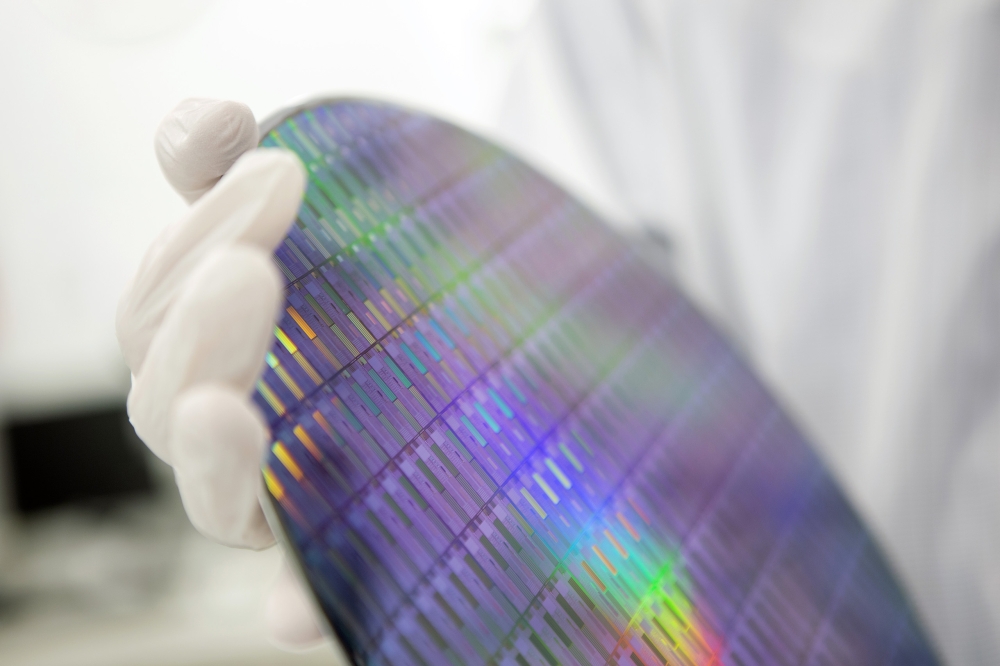

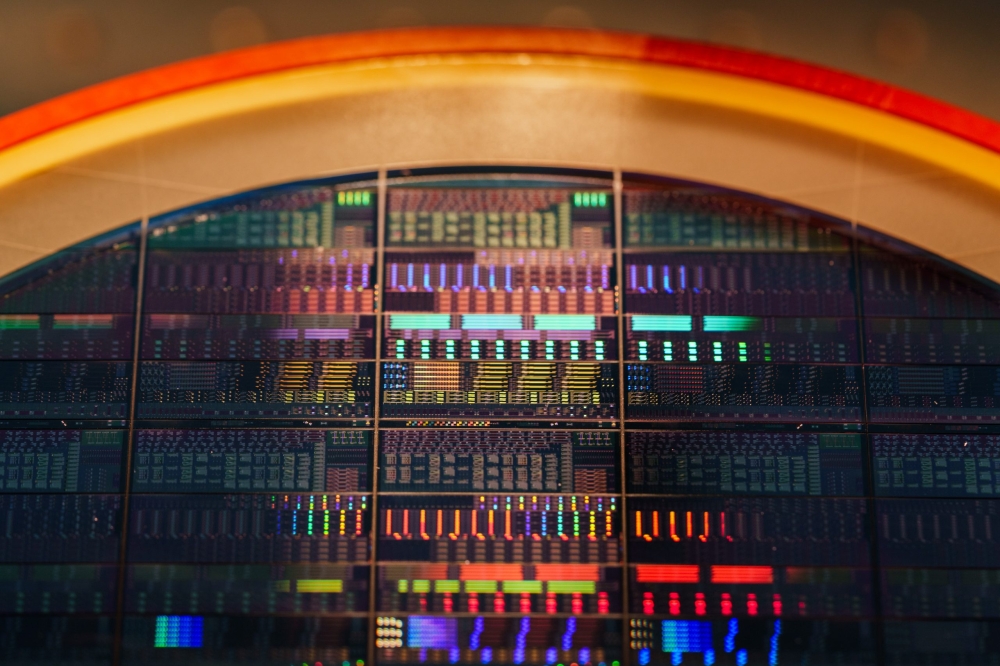

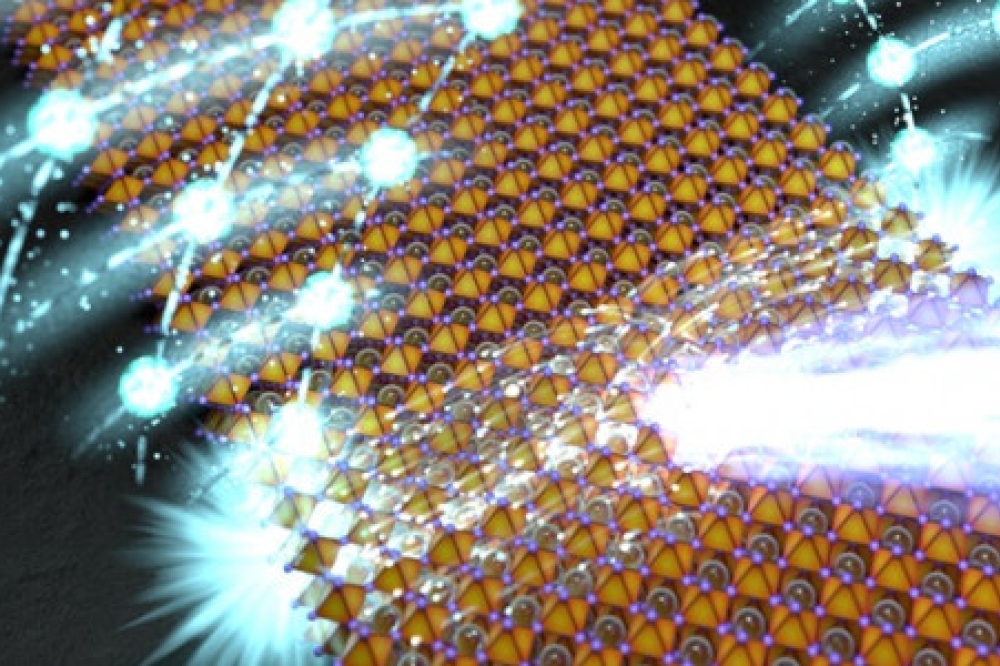

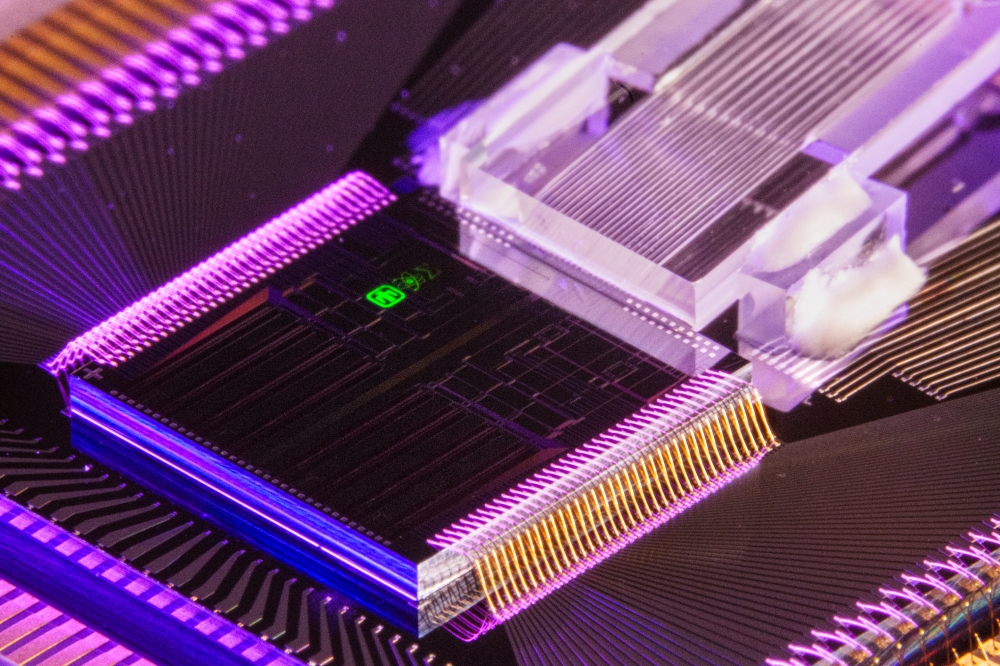

Sales of active elements for telecommunications systems, primarily laser diodes, more than doubled last year, and strong growth is predicted for the next few years. The thirst for bandwidth caused by the Internet revolution and the recent interest in installing short-haul "metro" systems have helped fuel this situation. The spiraling growth of this sector has led to the expansion of existing optical components suppliers, and also to the setting up of new specialist component suppliers to the industry. Many of these have spun out of universities, or are closely linked to them, as academic research finds real applications. The next-generation optical networks are likely to be based on functions executed directly in the optical domain, reducing the number of conversions between the electronic and optical domains. Integration of active and passive elements on the same optical chip is also attracting a great deal of interest. Here we take a look at some European start-up companies that are supplying active components based on compound semiconductor materials. Ulm Photonics Schott Communications Technologies of Sturbridge, MA, is the lead investor in a German start-up. Ulm Photonics GmbH is based in Ulm and was established last year. The new company specializes in oxide-confined VCSELs and has its own production facility. Ulm Photonics was founded by researchers from the optoelectronics department of the University of Ulm. The group was the first in Europe to develop oxide-confined VCSELs, which are associated with low threshold currents and high modulation bandwidths (see ). Ulm Photonics has an MBE system to grow epiwafers for VCSELs in the 710980 nm range; other material is purchased externally. The company says that challenges in production are to get an outstanding and homogeneous wafer material and to perform reproducible lithographic processing. Ulm Photonics is already supplying products: these include 850 nm multimode VCSELs operating at up to 3.125 Gbit/s, 1-D and 2-D multimode arrays at 850 and 980 nm, and 1 mW singlemode VCSELs operating between 780 and 1020 nm. The next generation of products will include both single- and multimode VCSELs at 850 and 980 nm operating at up to 10 Gbit/s, and a multimode device producing more than 1 W output power (see ). u 2t An older German start-up is u2t Innovative Optoelectronic Components, based in Berlin and founded in 1998 by three researchers from the Heinrich-Hertz-Institut fr Nachrichtentechnik (HHI). The institute houses the "Center of Excellence for InP Technology in Germany" and technology developed in this center forms the base for the company. Its current products include ultrafast waveguide-integrated photodetector modules and chips. u2t also manufactures InP-based modulators that are designed using ultrafast travelling waves from a single RF supply, and provide a bandwidth of up to 50 GHz. Nanoplus A third German start-up, also founded in 1998, is Nanoplus Nanosystems and Technologies GmbH, based in Wurzburg. The company s main products are DFB lasers, although it also produces a range of FabryPerot (FP), MQW and quantum-dot lasers, using a variety of materials including InGaAs, InGaAsP, GaInNAs, InGaAs/AlGaAs and Ga(In,Al)SbAs. Using technology developed at the University of Wurzburg, the company produces DFB lasers at customer-specific wavelengths in the 7002300 nm range with high spectral purity (typical sidemode suppression ratio of > 35 dB). In this novel design, lasers are fabricated with metal gratings patterned laterally to the laser ridge: unlike conventional DFB lasers this structure does not require epitaxial regrowth. In the InGaAs/AlGaAs system monomode emission of up to 64 mW and sidemode suppression ratios of more than 45 dB have been obtained in laboratory trials in the university. AIFOtec AG AIFOtec AG, based in Martinsried near Munich, was also launched in 1998 as a profit center within the AMS Electronic Group. The company supplies a range of DFB and FP lasers and PIN photodiodes, although it does not manufacture the semiconductor chips. At the Optical Fiber Communication exhibition held in Anaheim, CA in March (OFC), AIFOtec introduced a fiber grating laser (FGL) consisting of an FP laser and a grating fiber-optic components contained within the fiber (in contrast with DFB lasers, where the grating is part of the laser chip). The company claims the FGL approach provides higher flexibility and yield as well as longer transmission distances due to reduced chirp. The laser source for the FGL has an integrated spot-size converter, which improves coupling into the fiber. AIFOtec plans to build a facility in Berlin to manufacture these and other types of advanced laser chips. The company is also focusing on the development of hybrids, using silica-on-silicon as a platform technology, as well as manufacturing automation. One example is the use of a high-precision laser-welding technology, utilizing a special process to avoid post-weld shift of components. Marconi Optical Components While not a new company, Marconi Optical Components represents a new business venture in the UK. The unit, formed in December 2000, combines Marconi Caswell laboratories skills in optical design, material science, semiconductor technology and module optical design with the optical amplifier design and manufacturing expertise of Marconi Applied Technologies, based in Chelmsford. The unit also combines experience in InP and GaAs components with silicon expertise from Applied Technologies. The new company will add a purpose-built, automated volume manufacturing facility. Caswell announced last year that it was converting its existing GaAs wafer fabrication facility to process wafers 6 inches in diameter. The first products from the new company include a tunable laser with wide tuning range and high-power and high-data-rate (1040 Gbit/s) optical modulators. There will also be a strong emphasis on R&D programs to provide fully integrated solutions combining active and passive functions for high-value sub-system applications. CST Scotland s optoelectronics industrial base has expanded dramatically over the past few years. One key player is Compound Semiconductor Technologies (CST), a III-V optoelectronics foundry and technology-transfer company (see Compound Semiconductor Sept/Oct 2000, p27). CST has already acted as an incubator for two start-ups, Intense Photonics (see box) and Kamelian, and also undertakes foundry work at its facility in Glasgow. Kamelian One of two companies to emerge from the CST incubator, Kamelian is developing InP-based semiconductor optical amplifiers (SOAs). These will be integrated with externally fabricated passive components, such as arrayed waveguide gratings (AWGs), on a silicon micro-bench to form highly functional hybrids (see Compound Semiconductor April 2001, p41). Kamelian is currently using CST for prototype manufacturing and is building its own facility in Oxford, England. At OFC the company demonstrated an eight-channel reconfigurable optical adddrop multiplexer (OADM) based on an array of SOA gates. Samples of the reconfigurable OADM and discrete SOAs will be available in the next few months. Salento Innovation Technology In Italy a commercial spin-off from the Nanotechnology Research Group at the University of Lecce is in the process of being established. Salento Innovation Technology aims to develop new quaternary (InGaAsN-based) heterostructures for active devices operating at 1310 and 1550 nm. According to Lecce group leader Roberto Cingolani, for the first three years Salento IT will focus on R&D work, although it has been set up as a profit-making company. Purpose-built laboratories will be ready in a few months, at which point the company will start its research program. Cingolani aims to capitalize on the experience and production capability within his group to sell R&D to outside companies. The Lecce group already works with InGaAs- and InGaN-based materials, and has extensive MOCVD reactor and cleanroom facilities. The nanotechnology division is based on a complete facility, consisting of a class-10 000/1000 cleanroom, various kinds of lithography, reactive ion etching, plasma-enhanced CVD, mask aligner and device packaging and fabrication facilities. It has produced novel quantum-wire as well as quantum-dot lasers. Optillion New in Scandinavia is Swedish start-up Optillion, currently based in Kista. Optillion plans to develop and manufacture highly integrated, ultrahigh-bandwidth Ethernet transceivers for next-generation networks. The company recently received second-round funding of $53 million to help finance its new high-volume manufacturing facility. Products will include InGaAsP-based lasers, as well as modulators and detectors, which will be integrated onto silicon platforms to produce transceiver modules (see Compound Semiconductor March 2001, p9). Modulight Based in Tampere, Finland, Modulight is another Scandinavian start-up. The company is currently in the product development stage, but hopes to be in production by summer this year in a new purpose-built facility. Its range includes lasers, amplifiers and receivers, shipped fiber-optic components as chips and processed wafers and based on InP and GaAs-based materials. Modulight was founded in May 2000 by a group of researchers from the Optoelectronics Research Center at the Technical University of Tampere (TUT), with funding provided by the French company Picogiga, a producer of compound semiconductor epiwafers for microwave applications. The company currently has 14 employees, and is developing transmitters, receivers and higher-power lasers. The focus of Modulight s 1310 nm and 1550 nm transmitter products is on short- and intermediate-reach medium-speed networks. The lasers are FabryPerot in design and operate at up to 2.5 Gbit/s. Receiver products are based on high-speed, high-sensitivity avalanche photodetectors (APDs). The company is also developing aluminum-free higher-power pump lasers for EDFAs. Avalon Photonics New Swiss company Avalon Photonics, based in Zurich, spun out of the Swiss Center for Electronics & Microtechnology SA (CSEM) in June 2000. Avalon also has links with the Paul Scherrer Institute in Zurich, where CEO Karlheinz Gulden was previously responsible for VCSEL development. The new company was set up to develop and manufacture optoelectronic products in general and VCSEL arrays in particular, targeting the short-reach, high-bandwidth data communications market. In September 2000 the company raised $14 million in venture capital. The funding is being used to extend production and optoelectronic engineering capabilities to allow the manufacturing of volume products. As part of CSEM Avalon was active in developing single- and multimode VCSELs (see Compound Semiconductor July/August 1999, p34), including the first 16 16 individually addressed VCSEL array for optical interconnects. The company uses multiwafer MOVPE reactors and lithographic processing to produce AlGaAs wafers. Current products include 1 4 and 1 12 VCSEL array chips operating at 850 nm at up to 3.125 Gbit/s. Experimental 2-D VCSEL array chips are also available with an 8 8 configuration. Development is currently centered on 10 Gbit/s VCSELs, high-power bottom emitting arrays, integration of defractive optics and customer-specific projects. Longer-term research is focusing on long-wavelength VCSELs. QDI Germany GmbH For the last three years Quantum Devices Inc. (QDI), an optical device manufacturer based in Yorba Linda, CA, has co-operated with the HHI to develop laser chips. At the start of 2001 QDI established a subsidiary, QDI Germany GmbH, to transfer the technology developed at HHI into a high-volume manufacturing source of tunable lasers. Chips are currently fabricated by QDI in facilities leased from HHI; production will be transferred to a purpose-built fab with a 750 m2 cleanroom area. By the end of next year QDI will invest about 710 million ($9 million) in the new facility, which will increase its production level from 200 to 100 000 chips per month. QDI uses DFB lasers for its tunable modules; the wavelength is selected by adjusting the temperature. Although these devices offer slower tuning and a narrower tuning range than electronically controlled DBR-type lasers, QDI feels that DFB lasers are a field-proven technology offering very high reliability and wavelength stability. QDI s first tunable product, -Light, is a 1 mW device with tuning over four wavelengths at 100 GHz spacing; the WSL device, due to be released in June, will cover between eight and 16 wavelengths. ThreeFive Photonics BV Finally the newest company around is ThreeFive Photonics BV, which is based in Delft, The Netherlands. ThreeFive spun out of the Photonic Integrated Circuits group of the Delft University of Technology earlier this year, with funding from the Gilde IT Fund. The company is planning to offer monolithically integrated InP systems, and believes that InP is the platform for next-generation optical networking. The material allows the construction of extremely compact devices because of the relatively high refractive indices of InP and its ternary and quaternary derivatives (see ). These high refractive indices allow for small curve radii, leading to components that are as least 10 times smaller than current state-of-the-art silicon technology. As an active material it is also ideally suited to monolithic integration, with active and passive components on the same platform. The company claims that incorporating SOAs in these devices can compensate for the higher insertion losses which are associated with InP.