A bright future for the global PIC market

The latest report from IDTechEx predicts that the global PIC market will see robust growth, reaching $22 billion by 2034. But which applications are likely to grow the most? And what commercialisation challenges do PICs still face?

By James Falkiner, Technology Analyst at IDTechEx

From sending and receiving billions of bits of information in a package the size of a candy bar to detecting different molecules in the air with remarkable sensitivity, PICs are a powerful technology that can be adapted for a wide range of uses. These tiny optical systems, made of materials such as silica (glass), silicon, and indium phosphide (InP), have already experienced commercial success in telecoms and datacoms, and show plenty of promise for future growth.

By leveraging the billions of dollars of investment in CMOS chips, for instance, PICs can unlock new potential for scaling information processing beyond Moore’s law.

However, there remain significant challenges for the PIC market, such as material limitations, integration complexity, and cost management. Large demand volumes are required to offset the high initial costs of designing and manufacturing PICs, while production lead times can take months.

IDTechEx’s new PIC report thoroughly investigates the market for this technology and identifies photonic transceivers for AI as an emerging segment that will soon be the largest source of demand for photonic chips. This is because PICs can overcome some of the challenges faced by traditional optical transceivers, including data limitations associated with bandwidth, modulation speeds, and noise. PIC-based transceivers can thus send more data in a similar form factor.

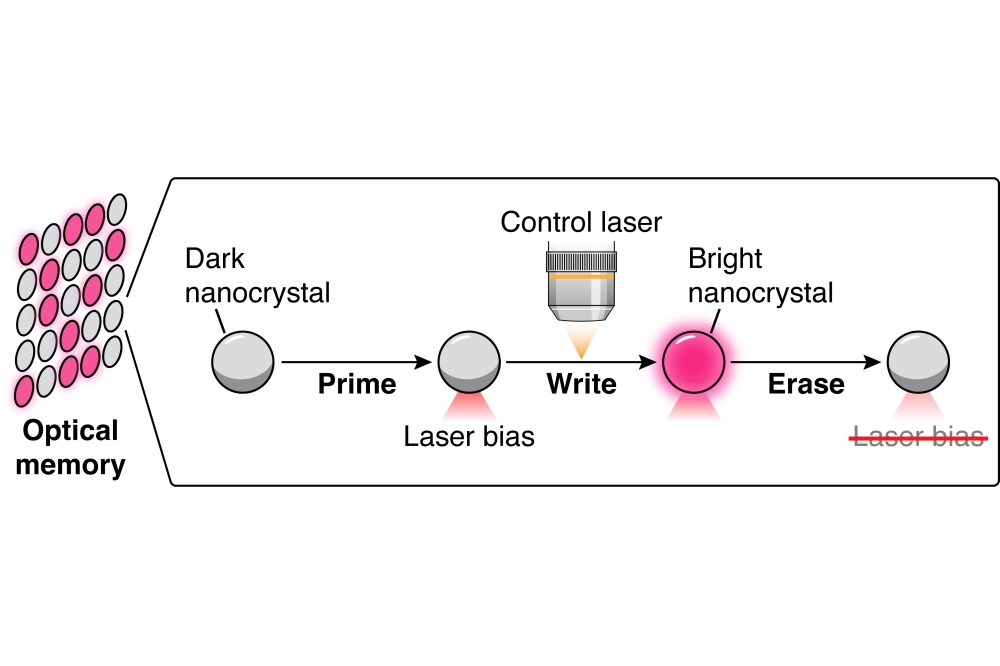

Figure 1 shows a traditional pluggable optical transceiver on the left with large independent transmitter optical sub-assembly (TOSA) and receiver optical sub-assembly (ROSA) circled in orange. On the right is a PIC-based transceiver of a similar size, but which offers 10 times the performance thanks to the large PIC-based TOSA under a heatsink. Under that heatsink is a PIC that controls the transmitting laser (bonded to the PIC), modulator systems, and passive optical components used for wavelength-division multiplexing (WDM), a method used to increase the data rate.

Figure 1: A traditional pluggable optical transceiver (left) compared with a PIC-based transceiver (right). The PIC-based transceiver offers around 10 times the performance of the traditional transceiver, despite being a similar size, thanks to a transmitter optical sub-assembly (TOSA), which is situated under a heatsink and contains passive optical elements that increase the data rate through wavelength-division multiplexing.

Materials on the horizon

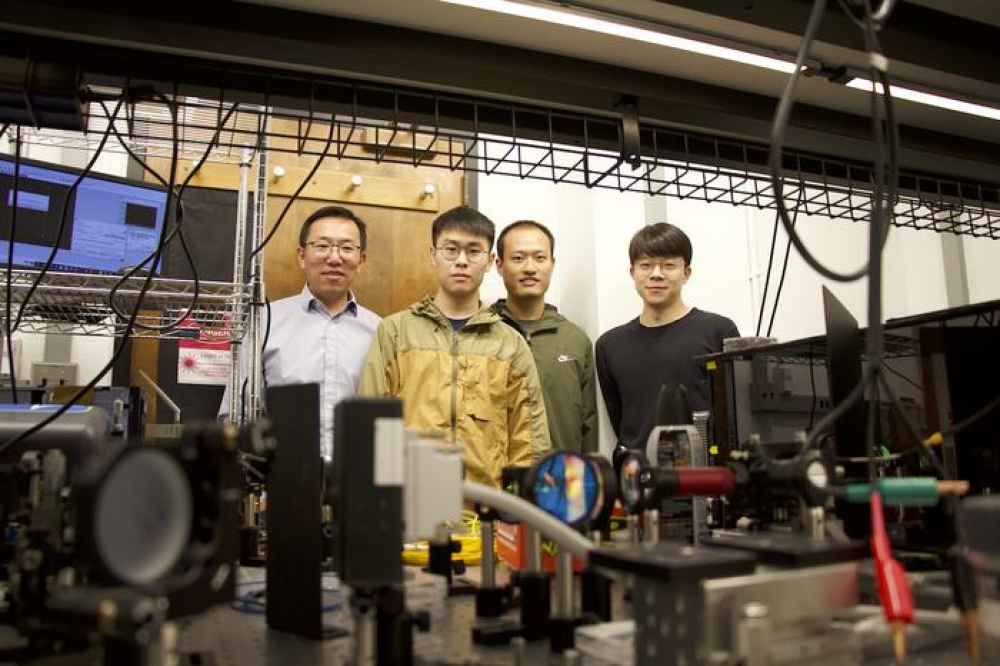

Although silicon photonics has generally been the most widespread platform for commercial PIC devices, researchers in both academia and industry are investigating alternative materials for various applications.

As part of our analysis of the PIC market, IDTechEx has evaluated some emerging and popular materials. We compare important performance metrics, such as cost, scalability, losses (power lost per metre), and modulation performance. The latter is defined as how quickly a material changes when exposed to an electric field, and is a critical factor for high-performance transceivers.

Although most of the current market uses silicon- and silica-based PICs for light propagation, silicon, as an indirect semiconductor, is not an efficient light source or photodetector. Therefore, it is usually combined with III-V materials, like InP, for photon emission and photodetection functionalities.

Silicon’s market dominance looks set to continue. However, thin-film lithium niobate (TFLN), with its moderate Pockels effect and low material loss, is emerging as a strong contender for applications that require high-performance modulation, such as quantum systems and potentially also future high-performance transceivers. Monolithic InP continues to be a major player due to its light detection and emission abilities. Additionally, innovative materials like barium titanate (BTO), electro-optical polymers, and rare-earth metals are being explored for their potential in quantum computing and other cutting-edge applications.

AI impacts

The rise of artificial intelligence (AI) has spurred an unprecedented demand for high-performance transceivers capable of supporting the massive data rates required by AI accelerators and datacentres. Silicon photonics and PIC technologies are at the forefront of this revolution, with their ability to transmit data at speeds of 1.6T and beyond.

As shown by Nvidia’s latest Blackwell CPUs, which, according to our research, require approximately two 800G transceivers per GPU, the need for efficient, high-bandwidth communication is becoming more critical for AI, positioning silicon photonics and PICs in general as essential components in the AI-driven future. Indeed, the biggest driver of PIC-based transceiver development is AI, since higher-performance AI accelerators will require higher-performance transceivers, with 3.2T transceivers expected to arrive by 2026, as indicated in Figure 2. Based on past trends, we forecast that future AI accelerators will require two optical transceivers per accelerator on average on launch, with in-generation transceiver improvements resulting in a lower transceiver per accelerator ratio throughout the estimated eight-year lifespan of an accelerator.

Figure 2: A roadmap for PIC-based pluggable transceivers. 3.2T transceivers are expected to arrive by 2026.

The AI accelerator market is set to see significant short-term growth with the H100 and B100 GPUs, alongside Google, Microsoft, and Amazon’s upcoming dedicated products. Beyond 2026, IDTechEx forecasts that the market will not see the same level of demand that we see in 2024, due to a slowdown in datacentre growth, and satisfaction with and consolidation of the current emerging AI and large language model (LLM) market.

In the short term, we expect to see rapid growth in global datacentre numbers. However, datacentre spending is set to slow beyond 2026 as datacentres start to satisfy global AI demand. Beyond 2030, datacentre performance and capability will be improved through the renovation and refitting of existing datacentres with faster AI accelerators, satisfying AI demand and leading to reduced numbers of new datacentres.

According to our analysis, datacentres already use about 1 percent of the world’s energy, so there is a limit to how much they can grow before they start running into wider electrical infrastructure limitations. Datacentre growth is likely to have a significant impact on the PIC market, as PIC-based transceivers are a critical component for transferring data to, from, and within this infrastructure. IDTechEx forecasts that by 2034, there will be over 15 000 datacentres globally.

Emerging applications

Silicon photonics and other kinds of PICs are being used to innovate new solutions in a wide range of fields, as illustrated in Figure 3. IDTechEx has explored several of the most prominent applications and the advantages they can offer within their respective industries.

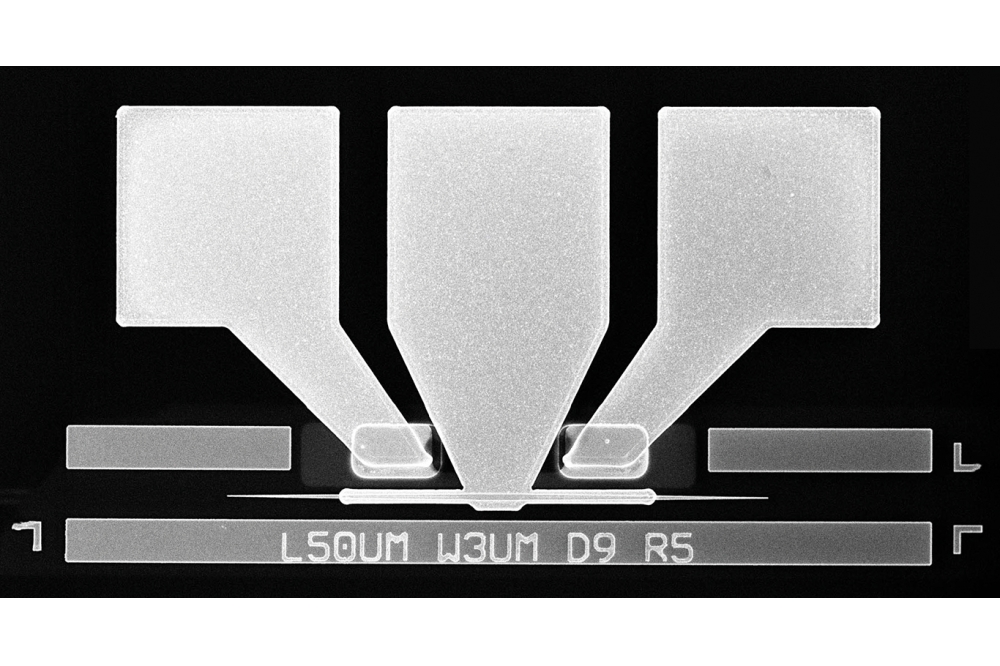

First, within the area of photonic engines and accelerators, photonic components such as Mach-Zehnder Interferometers and low-loss waveguides can be used to design and manufacture high-performance photonic processors and programmable PIC devices. This could unlock higher performance than is possible with electronic accelerators alone. These photonic accelerators can perform certain mathematical functions extremely quickly, potentially having applications in machine learning and AI matrix operation.

In the sensor market, PIC materials, such as silicon nitride, can enable a range of different technologies, from gas sensors to “artificial noses.” The healthcare sensor industry may be able to take advantage of the miniaturisation of optical components into PIC devices, which could see applications in point-of-care diagnostics or wearable tech. Meanwhile, PIC-based frequency-mode continuous-wave (FMCW) LiDAR has the potential to transform the automotive and agricultural industries, with applications in drones and autonomous vehicles. As the quantum revolution continues to unfold, companies investing in quantum computing based on trapped ions and photonic qubits are looking to PICs for more stable and scalable quantum systems. PICs are used in photonic quantum systems to achieve the precise control of photons necessary for quantum computation.

Figure 3: PICs have a wide range of applications, some of which they are already well established in, and others which are still on the path to commercialisation.

Another promising application area for PICs is in high-bandwidth chip-to-chip interconnects. By taking advantage of co-packaged optics (CPO) and external lasers, PICs can be used to replace copper interconnects within AI accelerator systems, offering greater bandwidth and better power efficiency at high data rates. IDTechEx expects to see significant adoption of CPO in 2026/2027.

Finally, the industries in which integrated photonics is already most established are telecoms and datacoms, both of which employ PIC-based transceivers. The volume of units associated with the telecoms (long-distance data transmission) market is smaller than that associated with the datacoms market. However, the cost per transceiver is much higher in telecoms, often 10 times the price, making this market relatively lucrative.

In telecoms, PIC-based dense-wavelength division multiplexing (DWDM) transceivers are critical for aggregating the signals from 5G base stations to distribute to the wider network. DWDM transceivers can combine the data of several 5G base stations within a backhaul connection. IDTechEx forecasts strong growth in the 5G market, with 5G PIC transceivers set to benefit.

The rest of the telecoms market is set to slow, growing at a 1 percent CAGR. Pluggable PIC telecom transceivers are used to send data hundreds of kilometres at high data rates, taking advantage of WDM to maximise the data rate sent through one optical cable. As discussed previously, datacoms (short-distance data transmission) is a fast-growing market due to AI-driven datacentre growth.

Figure 4: The global PIC market is forecast to grow by a factor of 2.4 to a value of $22 billion over the next decade. Datacom transceivers needed to satisfy the demand for AI are expected to be the biggest driver of this growth.

Market forecast

The overall PIC market is set to grow to over $22 billion by 2034, with a CAGR of 9.1 percent. As shown in Figure 4, we expect this growth to be primarily due to AI-associated demand for datacom transceivers. PIC-based LiDAR is expected to benefit from growth in the autonomous vehicle market, as well as having applications in agricultural and aerospace markets.

PIC-based sensors for wearables, point-of-care, and gas detection will likely each take a small percentage of their respective markets, although they are unlikely to dominate them. A quantum computer is unlikely to be fully commercialised by 2034 but will still represent a noticeable market size. Quantum systems will probably be a significant application for PICs by 2044.

Figure 5: The major players in PIC-based transceivers for datacoms and their market shares in 2023.

Overall, the market for silicon photonics and PICs is experiencing robust growth, driven by the surge in AI and datacom transceiver demand. Key players in the industry, such as Intel/Jabil, Coherent, and Infinera, are actively using PICs within their transceivers. Figure 4 shows the market share of these and other major firms in the PIC-based datacoms transceivers space in 2023.

Innolight, a China-based transceiver company, hit 1.6T of transfer speed in their most recent products in late 2023, which are due to start shipping for datacentre applications in 2024. Coherent, which has its own InP wafer fab facilities, is also developing higher-performance transceivers for 1.6T+ applications.

According to our analysis, Intel Silicon Photonics, which is potentially going to be acquired by manufacturing firm Jabil, sold about 1.7 million PICs in 2023, and is continuing to develop datacom and telecom transceivers. IDTechEx forecasts that PIC technology will continue to dominate the high-performance transceiver market, further solidifying its position as a critical component in the modern technological landscape.