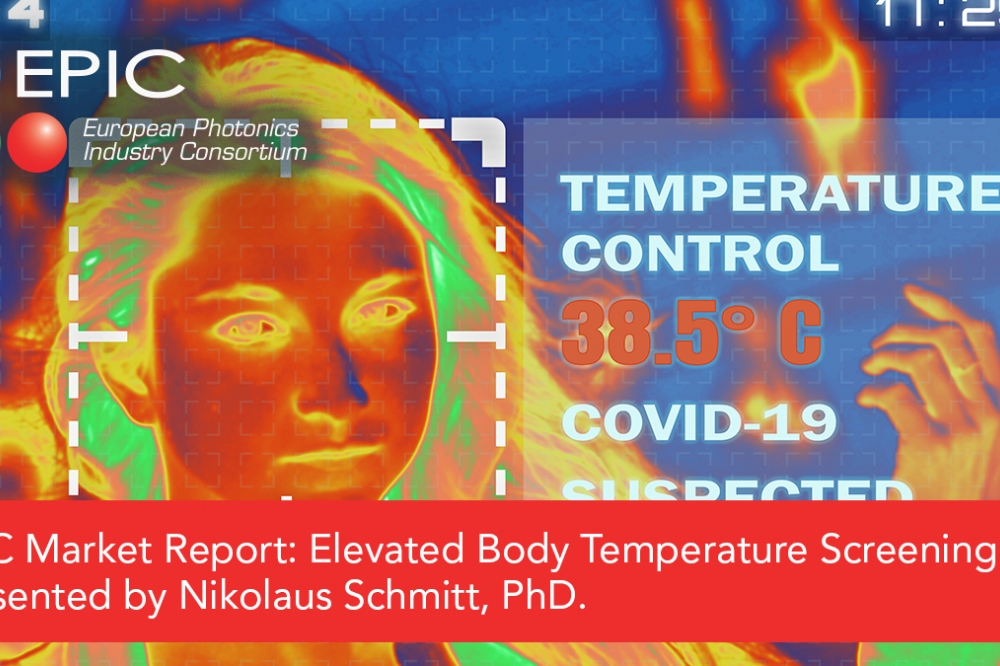

Will thermography sales continue to soar post COVID-19?

The European Photonics Industry Consortium (EPIC)

asked Nikolaus Schmitt, PhD, of Dr. Schmitt Consult to conduct a market

analysis of the sudden rise in body temperature scanning thermography device

sales to determine whether the surge was a one-time market ‘blip’ or an

indicator that this technology will continue to expand due to the public’s strong

desire to ensure health and personal safety. The following news release offers highlights

from Dr. Schmitt’s research.

The last year saw an enormous market increase in thermal imaging product sales, including Chinese based systems. Although market evolution is difficult to predict based on a singular ‘blip’ effect, if the current situation extends, there will be a moderate to strong increase of the thermal imaging market, based in part on new market applications.

Chinese manufacturers grew sales the fastest and now dominate global markets for portable, lower-cost systems; however, during 2019-20, sales by European manufacturers still grew 34%, pointing to the potential for long-term expansion should market conditions persist. This is an area of continuing research with many variables that may impact actual market performance, so manufacturers are encouraged to evaluate multiple resources before drawing conclusions about the potential for future thermographic device market growth.

· Market Developments:

Patents for thermographic fever imaging increased from an average of 2.5 per year to 48 new applications in 2020 alone. Market for thermography units increased by 426%, from 2019 to 2020, with Chinese companies accounting for largest increase from 15% to 61%.

· Main drivers:

Demand for elevated body temperature screening due to COVID 19.

High Chinese product growth due to ability to produce their own small pixel bolometers, independent from (US, EU) import.

· Future market development:

Unclear due to uncertainty regarding:

- continued use of thermal scans post COVID-19 pandemic

- development of regional/national/federal regulations and policies

- implementation of thermal sensors or cameras by mobile phone/tablet manufacturers and other consumer devices.

The technology

One of the symptoms of COVID-19 is an increase in human body temperature, i.e., fever. As thermal imaging cameras can measure body temperature without the need for contact, they are now commonly used at airports, cultural events and other venues that draw large crowds as a first line of detection of individuals who may have COVID-19.

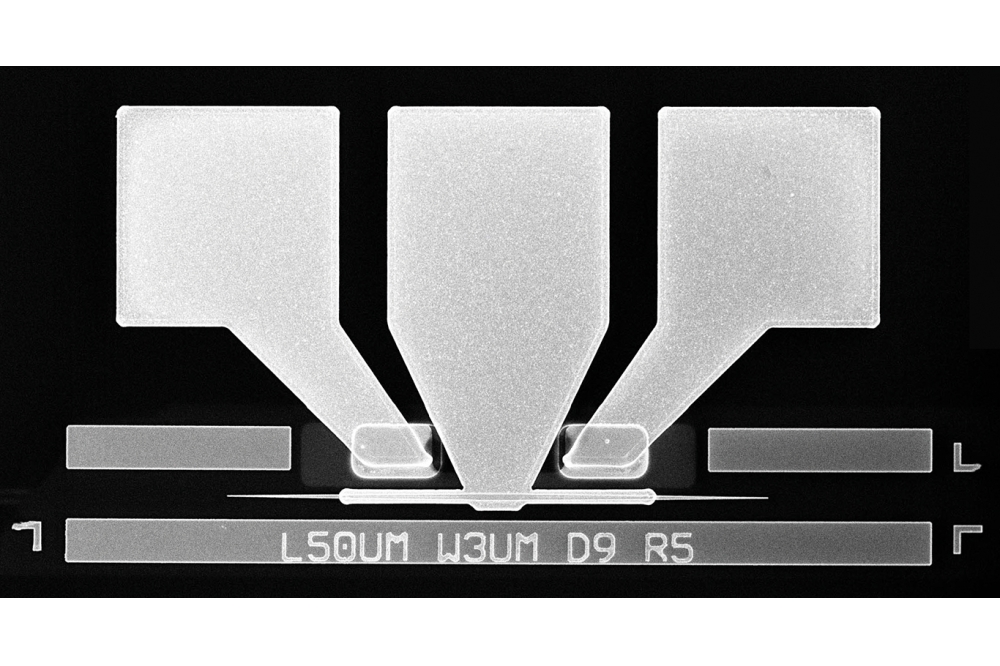

All objects with a temperature above absolute zero emit infrared energy, which can be measured by an infrared camera, also known as a thermal imager. The camera contains an optical system that focuses infrared energy onto a special detector chip (sensor array) that may contain thousands of detector pixels arranged in a grid. Each pixel in the sensor array reacts to the infrared energy focused on it and produces an electronic signal. The camera processor takes the signal from each pixel and applies a mathematical calculation to it to create a colour map that shows the apparent surface temperature of the object being measured.

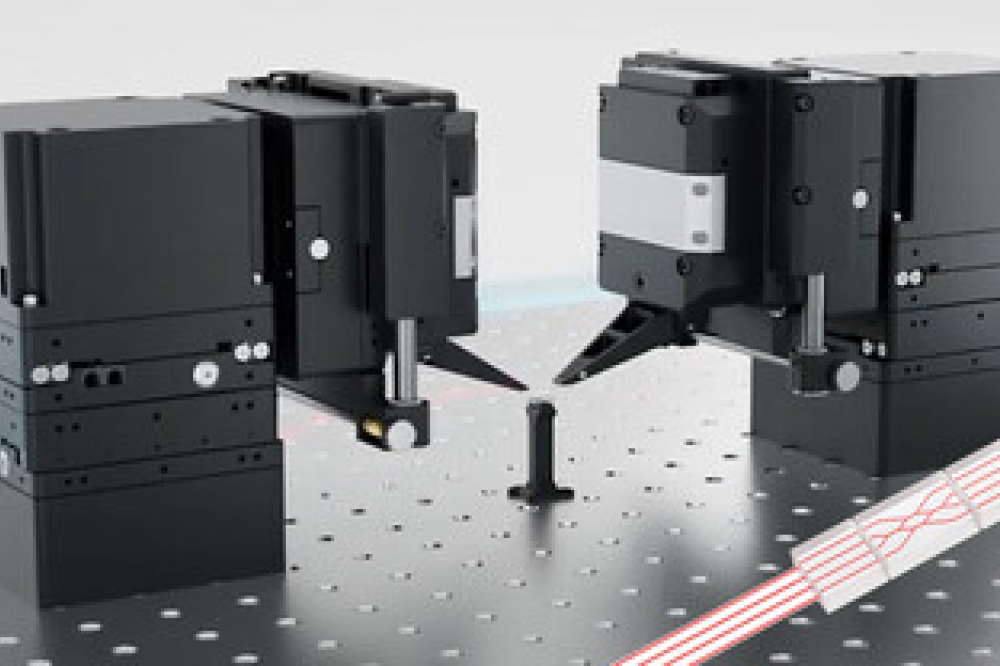

Thermal imaging cameras can be cooled or uncooled. The more common type are uncooled cameras, which have the infrared-detecting elements contained in a unit that operates at room temperature. They can be activated immediately and need relatively little installation or configuration. Additionally, some are portable, making them ideal for changing test locations.

Cooled devices, on the other hand, have detectors stored in a cryogenically-cooled unit around 77°K (-321°F, 196°C) providing them with incredibly high resolution and sensitivity. Although cooled thermal imaging cameras are both more expensive and more susceptible to wear and tear than uncooled systems, for long range applications where there is a large influx of people, cooled cameras are currently the only ones effective enough for use in these situations.

Customers

The major customers were retail shops, banks, museums, event organizers, companies, government organisations and travel infrastructures, e.g. airports, train & bus stations. Procurement was not very coordinated. Although standards existed, purchasing agents leaned toward the purchase of less expensive cameras, without realizing many were non-compliant. Many systems were also developed within a short period of time and were derived from products used in other domains. A short delivery time of a less expensive, fully functional system was the preference.

Regional differences

During this period, there was a dramatic increase in the number of thermography units sold with the market (per unit) increasing by 426% from 2019 to 2020. However, the Chinese market share increase from 15% to 63% was at the expense of US, European, and Korean market shares.

The main reason for this disparity is that for some years, Chinese companies have been able to produce their own small pixel bolometers, independent from US and EU imports. The Chinese increase in market share was in spite of the fact that the largest Chinese manufacturers had been banned from a large part of the US market following the 2018 National Defense Authorization Act (NDAA).

Future market development

While it is difficult to make forecasts based on a singular blip event, there are three parameters (all unknown) that will strongly impact on the future development of the elevated body temperature screening thermography market:

1. Major consumer/purchaser policies: Will airports, border control, big companies, city authorities, event organizers and government organisations etc., continue with thermal control? Will such measures stay at the current level or even increase, or will thermal scans be abandoned after the COVID19 pandemic? If the current situation continues, there will be a moderate to strong increase of the thermal imaging market, unless the interest for thermal screening somehow stops, which would lead to similar market as before with typical increases.

2. National / federal regulations & policies: Will the US continue its ban of major Chinese camera manufacturers? Will the FDA insist on 501(k) certification for valid thermal scanning? If so, the market will decline at least until sufficient systems have achieved 501(k) certification. Will there be national laws for fever scan for access to certain events? Or will thermal scanning only be regulated for medical diagnosis? EU policy is unclear on these three points.

3. Technology and consumer market: Will SWaP (size, weight & power) and price decrease sufficiently so thermal sensors or cameras can be implemented in mobile phones and tablets? If so, there could be a very strong increase in the number of systems. Other considerations include whether surveillance cameras will be offered with an additional IR channel at low additional cost, and will traditional industrial application IR cameras implement a body temperature function? To what extent will thermal imaging bolometer chips drastically decrease in SWaP (Size, Weight, & Power)? Will very low cost sensors like thermopiles further increase in resolution? Will Artificial Intelligence (AI) and high resolution Focal Plane Arrays (FPAs) allow reliable crowd screening?

4. New Medical Applications: Will new applications emerge in the medical and veterinary markets that result in continued market growth past the current pandemic conditions.

The future for Europe

Despite a losing market share in 2020, due to the size of the global increase, Europe actually increased the number of thermography units sold by 34% compared with 2019. As Jose Pozo, EPIC Chief Technology Officer points out, “In the last few years we have seen a major growth by EPIC members developing IR cooled and uncooled detectors, and COVID-19 has shown the importance of this technology. We believe that Europe has some of the best technologies in SWIR* and MWIR*, and new applications are going to enable even further growth”.

Market data assessments:

There was a strong market blip for elevated body temperature screening thermography in 2019/2020 due to COVID-19. IR cameras tripled and detectors doubled in value, and the number of thermography units sold increased fourfold.

There was an enormous market growth for Chinese companies, now dominating the uncooled thermal imaging market based on the ability to produce their own small pixel / high pixel number bolometric sensor chips at a low price.

Having some of the best technologies in SWIR* and MWIR*, Europe is poised to exploit any future growth in the thermal imaging market.

EPIC reports provide information that can be used for corporate strategy, new product development, research, technology development, or marketing. They are freely available to EPIC members and their employees through EPIC’s extranet. *Acronyms: SWIR · Short-wavelength infrared; MWIR- Mid-wavelength infrared