ZTE Emerges as Trade Dispute Bargaining Chip

Chinese telecom giant ZTE has been at the center of an unfolding trade dispute between the United States and China. The company appeared to gain a new ally this past Sunday: US President Donald J. Trump. President Trump stunned observers when he tweeted that he was rethinking actions taken by the US Commerce Department to ban ZTE from purchasing sophisticated technological components from companies based in the US.

The action by Commerce officials was the latest in a long-running dispute between trade officials in the US and their Chinese counterparts. ZTE, which manufactures telecom and smartphone products that are sold across China and global markets, is merely the most recognizable name of the many companies on both sides that stand to lose if Washington and Beijing can't find common ground.

In a late afternoon tweet on 14th May, President Trump stated that, "ZTE, the large Chinese phone company, buys a big percentage of individual parts from US companies. This is also reflective of the larger trade deal we are negotiating with China and my personal relationship with President Xi." His initial communication on the 13th lamented the potential loss of jobs in China, which surprised both political allies and opponents since this came from the famously "˜America First' US president.

The case of ZTE highlights the important role that intellectual property rights and technological products play in US-China trade disputes, as well as how the two countries look at the role of government in their respective economies.

China's Foreign Ministry expressed appreciation for Trump's gesture, which some believe could help smooth crucial trade talks scheduled to begin on 15th May when China's top economic official, Vice Premier Liu He, arrives in Washington to meet with Treasury Secretary Steve Mnuchin. The two sides have so far imposed sanctions or threatened each other with billions of dollars in tariffs and failed to significantly narrow their differences even after Mnuchin led a delegation to Beijing earlier this month.

Many observers have stated that a trade dispute with China is the last thing this or any US administration needs after stepping away from the Iran nuclear deal while it is also readying for talks with North Korea regarding limits to that country's own nuclear weapons program. The potential for an executive intervention in the trade dispute sent Silicon Valley tech stocks rallying much of Monday in hopes that a thaw over ZTE might install at least a partial return to "˜business as usual' for America's tech exporters.

The ZTE case predates the current US-China trade disagreements. In March 2017, the Commerce Department hit ZTE with a $1.2 billion penalty for violating US sanctions on Iran and North Korea, and for misleading the US government about the firm's actions.

ZTE was also slapped with a suspended seven-year ban on the purchase of US tech products. That ban was activated in April after the US determined that ZTE failed to disclose key operational details.

"ZTE made false statements to the US government when they were originally caught," Commerce Secretary Wilbur Ross said in a statement last month. He added that the company, ""¦made false statements during the reprieve it was given, and made false statements again during its probation."

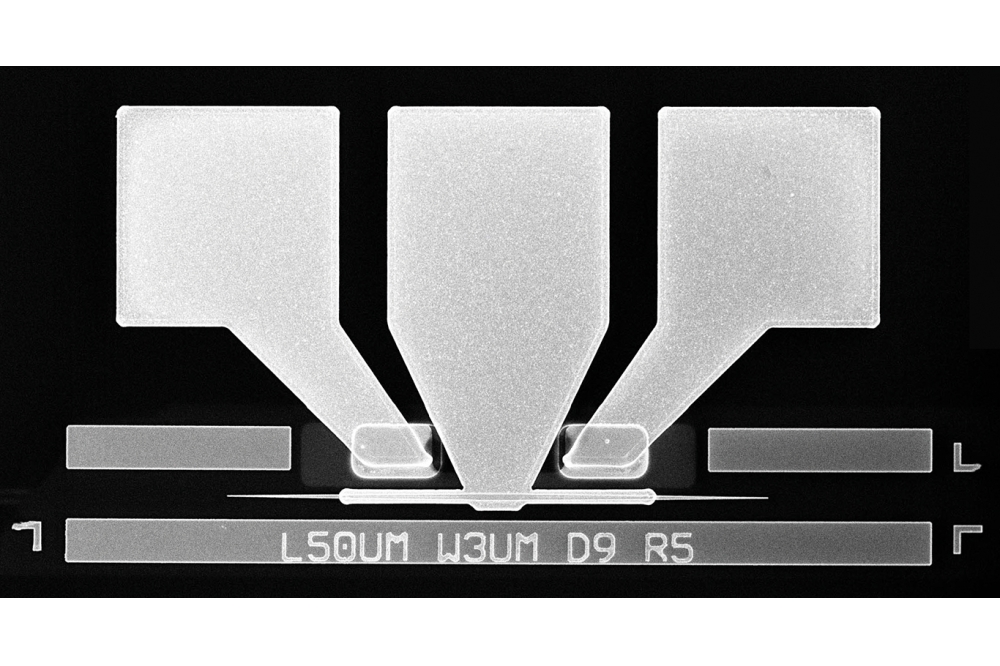

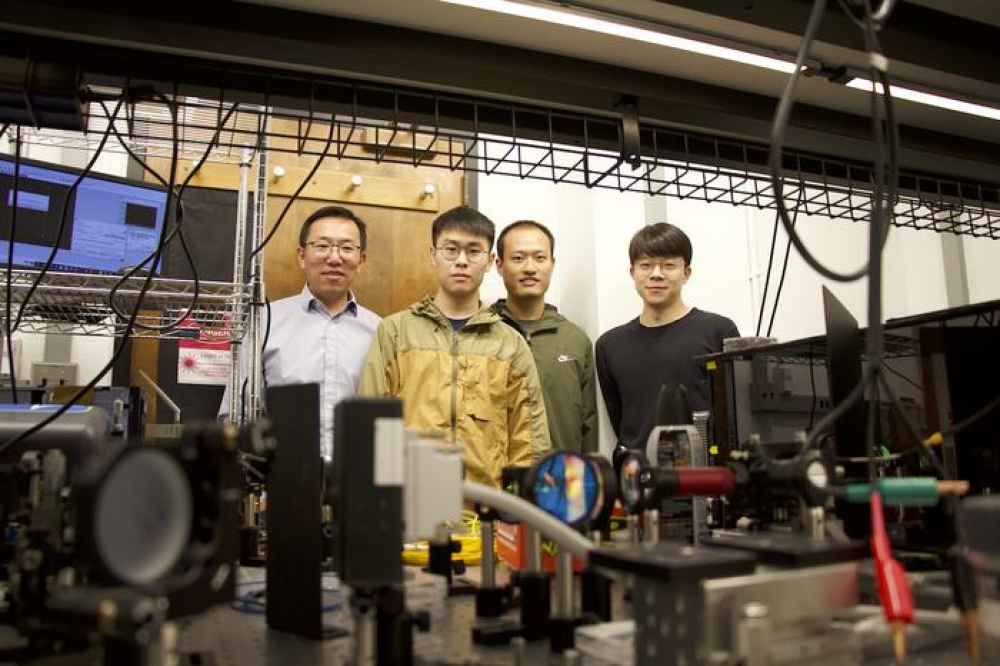

ZTE announced May 9 that its operations had ceased because it was unable to purchase the chips it uses in its products from US companies including San Diego-based Qualcomm. ZTE also purchases optical/photonic and other telecom products from Lumentum Holdings, Oclaro, Finisar and Acacia Communications; all companies saw their share prices rally on Monday after Trump's latest conciliatory tweets.

While the Chinese have been content to import large quantities of food along with "˜low tech' materials and products from the US and many other global suppliers, advanced manufacturing and the technology that enables it appears to have emerged as central to the overall trade dispute, according to economists and international political observers.

Technological advances and home-grown capabilities are not only valuable to both economies, they are foundational to 21st century cyber security protocols while playing critical roles in almost all offensive/defensive military capabilities. Technology is deeply associated with national security and military readiness, and as such it is a point of worry for both Chinese and US defense strategists. Both the US and Chinese governments are suspicious that one another's chips and smartphones might provide the governments behind each manufacturing block with "˜back doors' that could potentially compromise the security of user data, or provide easy access to defense computer networks that could leave either nation vulnerable if utilized.

While some economists believe the dispute could cause China to close itself off, over-emphasize self-sufficiency or even revert to a Maoist type economic vision, most believe that the country has gone too far down the road towards becoming a central player on the world stage to revert to isolationism. The economic and political advantages China receives from actively participating with other world governments is at stake, so all eyes are on the ZTE dispute and the symbolic role this one company and its many US suppliers have assumed while discussion gets underway that will affect both countries and the wider global technology marketplace that extends far beyond US and Chinese borders.