Cloud Demands to Drive Optical Growth Through 2023

LightCounting researchers project that optical sales could reach (USD) $6 billion by 2023 with growth driven by steady increases in the demand for cloud-based services.

Researchers at Light Counting (Eugene, Oregon,) have issued their latest 'Optical Communications Market Report,' that indicates the rapid demand growth for cloud-based services is compensating for declines in other areas. LightCounting said in announcing its latest report, "God bless the Cloud! It pulled the optical components market from a ditch last year and it is likely to do it again in 2018."

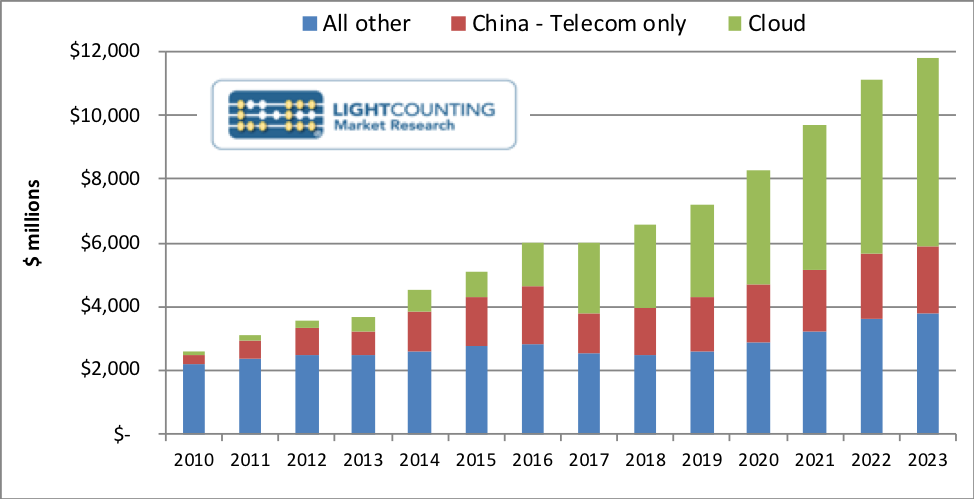

The researchers report that demand for 100 GbE transceivers from operators of mega datacenters in the United States remains strong and that cloud companies in China are starting to deploy this technology as well. They expect that sales for 400 GbE optics will expand the Cloud market segment (including Cloud in China) from about (USD) $2 billion in 2017 to more than $6 billion in 2023, as illustrated in the chart above.

Decline in the rest of the market in 2017 was mainly due to weaker than expected sales of optics to Huawei and ZTE, including optics sold for deployments in China (also shown in the figure as China- Telecom only). Suppliers of optical components and modules first reported sharp drops in sales to these customers in March of 2017 and this was related to excess inventory accumulated by Huawei and ZTE in 2016. Most of the excess inventory was depleted by the end of 2017, but suppliers continue to report slower than expected business with these Chinese customers. The latest ban on sales of US-made products to ZTE creates even more confusion in the market.

The researchers note that as their report was being finalized, new information was emerging on a criminal investigation of Huawei launched by the US Justice Department, related to a possible violation of export sanctions against Iran, which is the same offense that ZTE was convinced of. On a far more positive note, top-ranking US government officials are heading to Beijing to attempt to resolve the trade disputes. It is certain that ZTE's and Huawei's situation will be among the bargaining chips on the table, along with Qualcomm's acquisition of NXP, which needs to be approved by China.

In the best case scenario, the ZTE ban will be lifted in a matter of weeks and the markets will go back to normal. In case of a prolonged trade war, sales of optics by US-based companies to ZTE and potentially Huawei will drop sharply in 2018. This will do more damage to the business of the US-based suppliers than to Huawei and ZTE. The Chinese government will certainly help Huawei and ZTE to stay in business while dealing with disruptions in their supply chains, but none of the US-based optics suppliers are "too big to fail".

Researchers said they current forecast for sales of optics to China in 2018 assumes the best case scenario for resolving the situation with Huawei and ZTE, which account for about 50 percent of the global sales of telecom optical networking equipment. Needless to say, sales of optics used in telecom equipment will drop sharply in 2018 in case of a prolonged trade war, as many projects will be delayed.

However, the long term market forecast is unlikely to change, LightCounting notes. Both Huawei and ZTE embarked on a long-term strategy for reducing their dependence on Western optics suppliers several years ago. This strategy was elevated to the governmental policy level in 2017-18; the latest escalation of trade disputes by the US government only adds further urgency to this transition, they suggest. For more information about the report visit the LightCounting website.