Researchers See Optical Sales Jump, Prices Slide

The

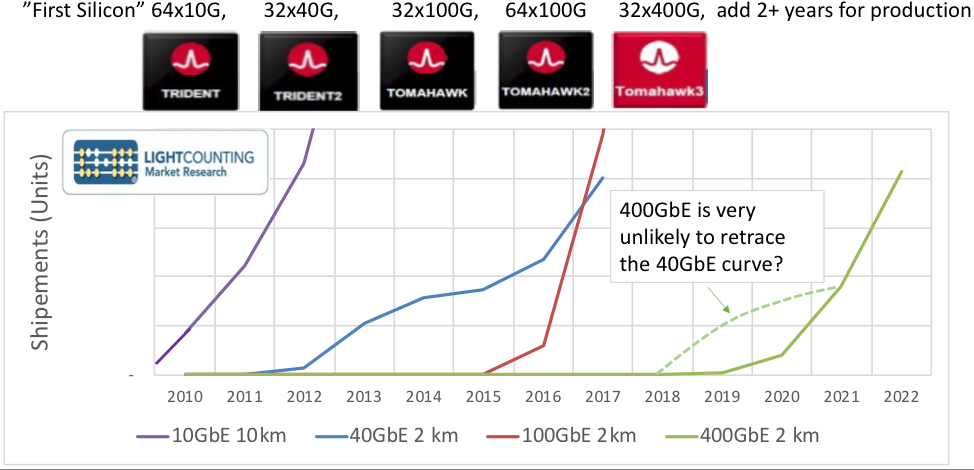

figure shows a correlation between the introduction of first switching silicon

and early shipments of Ethernet optical transceivers with 2 km reach (popular

in datacenters.) The forecast for 400GbE is the solid green line. The dashed green

line shows what researchers consider a very unlikely scenario in which 400GbE shipments retrace early

shipments of 40GbE (with a 6 year delay).

Researchers at LightCounting state that, "˜"¦it is still an exciting time for the optical industry"¦' but that increased sales are not always cause of celebration amongst global optical data transport suppliers. They note that the race to design and build higher speed optical transceivers is beginning to feel like running a marathon in their latest "˜High-Speed Ethernet Optics Report.'

Shipments of 100 GbE devices reached close to 2.9 million units in 2017 and are projected to exceed 5 million in 2018, they note. Yet, it does not feel "˜like a party' for suppliers since they needed to scramble to maintain profitability as pricing declined faster than expected last year. Some of the 100 GbE demand disappeared as it was discovered that buyers had placed duplicate orders. Development of 400 GbE products requires a lot of investment, but customers are unlikely to purchase these products until the pricing is "right," they note in their report. LightCounting researchers project that 400GbE shipments will likely retrace shipments of 100GbE for datacenter applications, which picked up in 2016, two years after the first 32x100G Broadcom Tomahawk switching silicon was sampled. With the 32x400G Tomahawk3 ASIC sampling in December 2017, first volume shipments of 400GbE will start in December 2019, making a real difference in 2020.

An alternative argument is that 40GbE started shipping two years after 64x10G switches were introduced, so 400GbE has to start shipping in 2018, two years after release of 64x100G Tomahawk2. This is very unlikely because of the complexity of 400GbE optics and the new silicon required. Production of 40GbE optics was mostly co-packaging of mature serial 10GbE technology elements. 100GbE optics today use 4x25G optics, and serial (single wavelength) 100G optics are just starting to become viable. This also will be the first time that PAM4 optics and electronics will be used, which is another hurdle for suppliers of optics, electronics and even test equipment.

The researchers note that live demos of 400GbE optical transceivers were given at the OFC in March 2018, but that many of these demos were put together a day or two before the show, since the first PAM4 chips did not function well and the second version was not available until right before the event. They believe it will take a year to debug PAM4 chips and switching silicon before the move to volume production; even if the optics are ready now, they believe integration and other issues will delay roll-outs. The researchers found that, "˜the customers seem to understand they will need to wait.'

LightCounting noted a change in this forecast update is a reduced forecast for 200GbE, which was originally expected to offer an early alternative to 400GbE, tracing the dashed green line in the figure above. Support for QSFP56 modules from equipment manufacturers has declined sharply in the past six months, despite remaining interest from enterprise customers. Google remains the only customer for 2x200GbE OSFPs that are known by the research team. Google has not commented on this latest forecast; however, it is believed that suppliers are starting to lose enthusiasm about the potential opportunity for these products.