Mellanox ends 1550nm Silicon Photonics Development

.jpg)

Company plans to deliver 200 gigabit, 400 gigabit and beyond cables and transceivers using other technologies

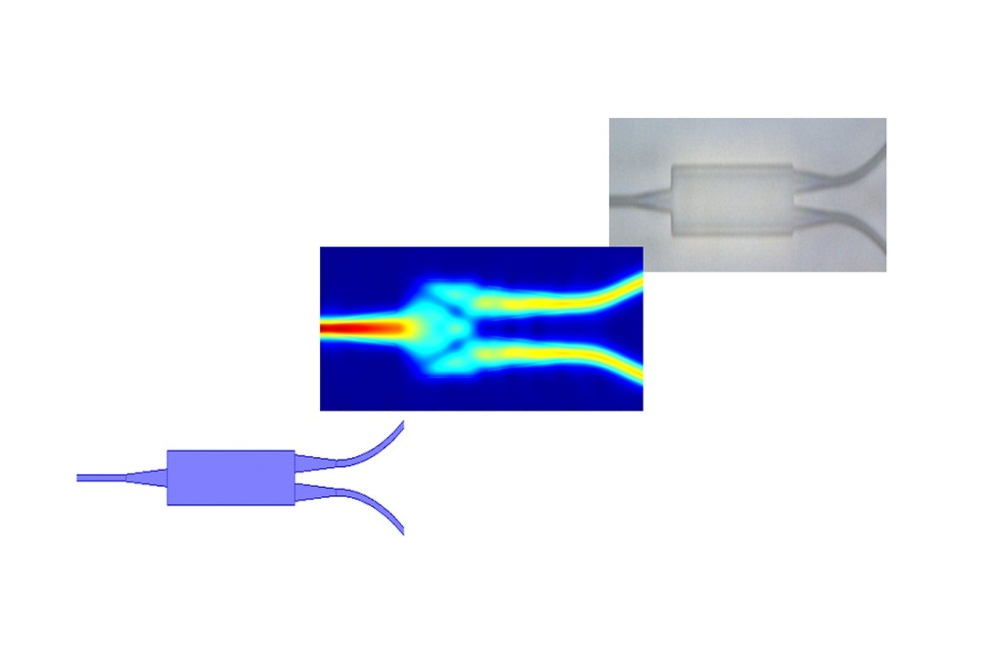

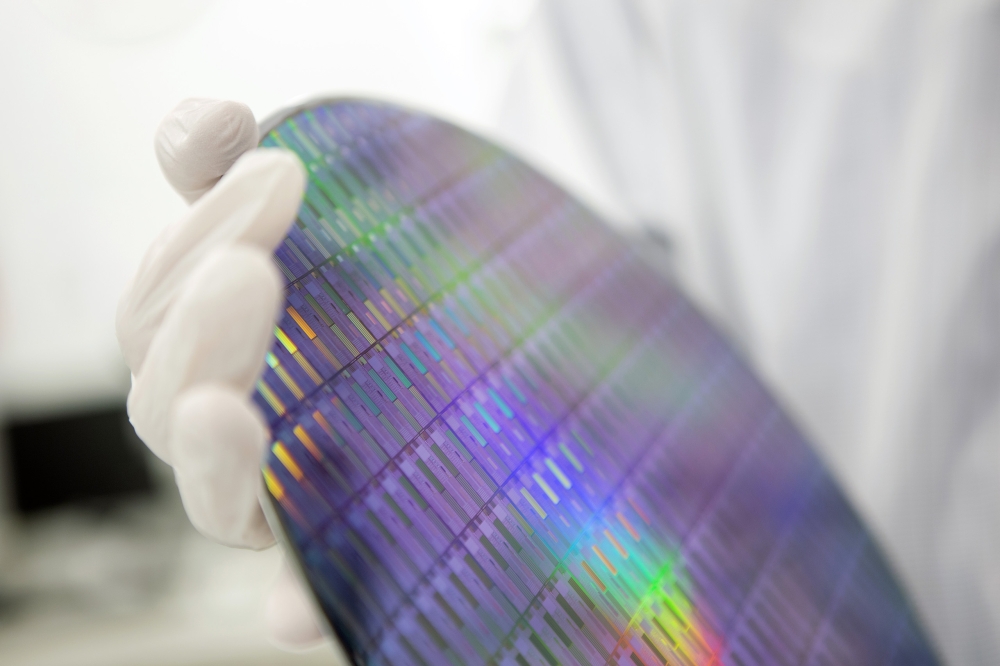

Mellanox Technologies, a supplier of interconnect solutions for data centre servers and storage systems, today announced that it will discontinue its 1550nm silicon photonics development activities, effective immediately.

The company expects that there will be no impact for the Variable Optical Attenuators (VOA) product and Mellanox will continue to sell to and support its VOA customers.

This action is expected to have only a minor impact on the LinkX cables and transceivers product line. The company plans to execute on its roadmap to deliver 200 gigabit, 400 gigabit and beyond cables and transceivers solutions on schedule, using other technologies including Mellanox own IC designs. The company intends to retain the silicon photonics intellectual property.

"The Mellanox board of Directors and management team continually review our strategic priorities and investments to ensure they meet our future goals. We began our review of the silicon photonics business in May of 2017, but as the business did not become accretive as we had hoped, we decided to discontinue our 1550nm Silicon Photonics development activities," said Eyal Waldman, president and CEO of Mellanox Technologies. "We appreciate all of the efforts of the silicon photonics team over the years and wish them success in their future endeavours."

The discontinuation of Mellanox's 1550nm silicon photonics development activities is not expected to have an impact on fiscal 2018 revenues and is projected to result in expected fiscal 2018 non-GAAP operating expense savings of $26 million to $28 million.

Also, this action will result in an estimated aggregate charge of $21 million to $24 million, including approximately $4 million to $5 million of cash expenditures "“ mostly related to the severance costs of a reduction in force of about 100 people "“ as well as approximately $17 million to $19 million of other charges, consisting primarily of non-cash items.

Mellanox expects to recognise most of the restructuring charges in the first quarter of 2018. Mellanox will provide more detail on its 2017 results and 2018 outlook in its fourth quarter earnings report which will take place on January 18, 2018.