Cloud data centre demand continues to surprise

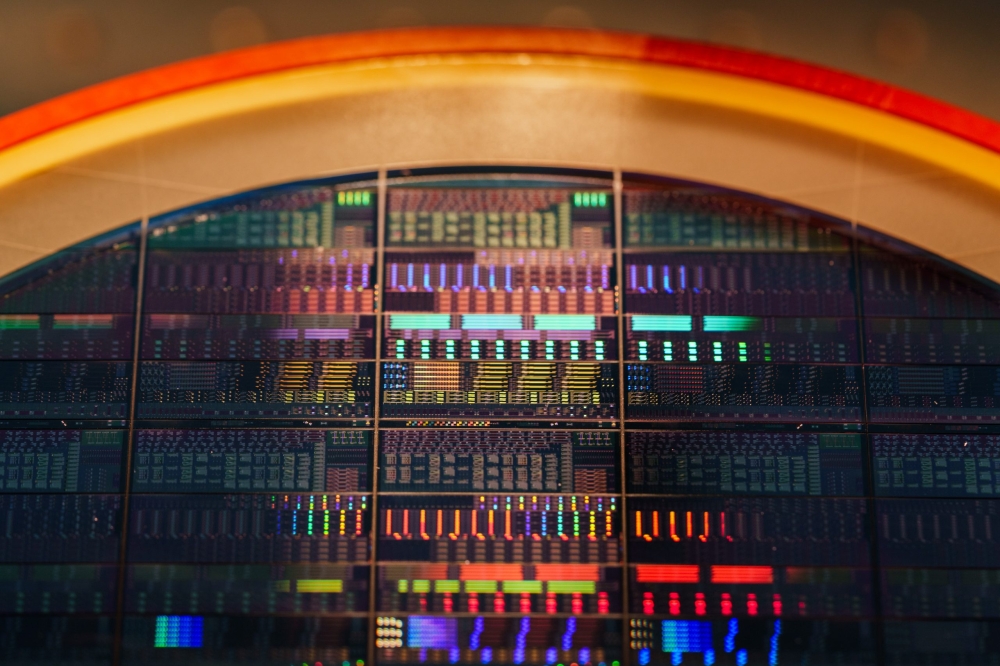

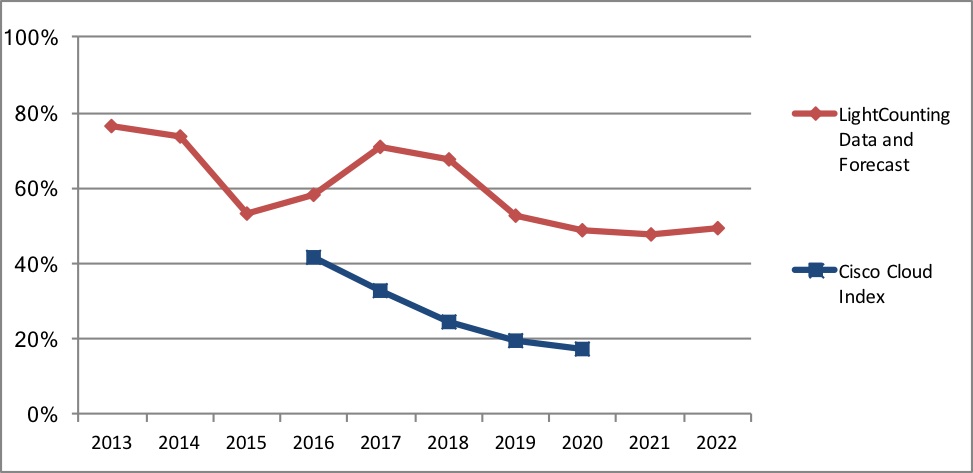

LightCounting's forecast for the growth-rate of bandwidth of optical connectivity inside Cloud data centres shows a sharp increase in 2016-2017

In its latest High-Speed Ethernet Optics Report, market research company Lightcounting says that demand surged for high-speed optics in 2010-2016, kicking off with early sales of 10GbE SFP+ optics to Google in 2007. Volume shipments of 40GbE optics exceeded 3 million units in 2016 with 78 percent shipped to Cloud customers. Shipments of 100GbE optical transceivers are likely to reach 3 million units in 2017, exceeding its previous forecast by 20 percent.

Lightcounting's forecast for shipments of 100GbE transceivers in 2017 was partly based on estimates for manufacturing capacity of leading suppliers.

Many of these vendors were able to ramp their production faster than expected and several new vendors started shipping 100GbE modules in 2017.

Leading customers for 100GbE products are planning to double and possibly event triple their purchases in 2018. It will be another busy year for suppliers trying to catch up with demand and make a profit. Reflecting this situation, Lightcounting increased projections for shipments of many 100GbE products in 2018. This also impacted its longer term projections, including our forecast for 400GbE optics.

LightCounting's forecast methodology includes correlation between the growth rates of the aggregated bandwidth of optical connectivity inside data centres and the data centre traffic. Amazon, Facebook and Google indicated that traffic in their mega-data centres increased more than 100 percent in 2016 and it is likely stay at this rate in 2017.

Data collected by LightCounting on shipments of optical transceivers to these vendors is consistent with close to 100 percent per year growth in traffic.

The graph above (showing the growth-rate of bandwidth of optical connectivity inside Cloud data centres) also shows projections for traffic growth inside Cloud data centres published by Cisco in 2016. The discrepancy between the curves illustrates how the industry underestimated the impact of mega-data centre operators on demand for optics.

The roadmap beyond 100GbE remains uncertain, says the research company, because there are too many directions to choose from. Its latest report offers a detailed analysis of this situation, including forecast for several categories of 200GbE and 400GbE transceivers.

Google is very clear its next speed will be 200GbE. However, Google wishes to deploy 200GbE ports in 2x200GbE module in the OSFP form factor. This makes sense in that a '400GbE' switch with 32 OSFP ports will provide 64 200GbE connections. By doubling the radix of their switches, Google will likely save one tier of switching. Microsoft and Facebook have said publicly they don't want 200GbE. AWS is less public but pushing hard for 400GbE. They all want 400GbE as their next speed.

Facebook's 400GbE strategy is changing. Previously, it prioritised 400G-FR4 MSA modules to deploy 400GbE. Its new architecture will mostly use 400G-DR4 QSFP-DD modules in breakout mode to 1x100G modules, which does not require a 400GbE MAC. This approach enables higher front panel density and 4X higher radix switches than will be possible with a 400GbE architecture. This means less tiers of switching, less latency and other benefits. They will also be using 100Gb/s lambda technology once it becomes available.

More information on the report is available at: www.LightCounting.com/Ethernet.cfm