NeoPhotonics to Restructure

Company hopes to achieve an approximately two-million-dollar reduction in the first quarter of 2018

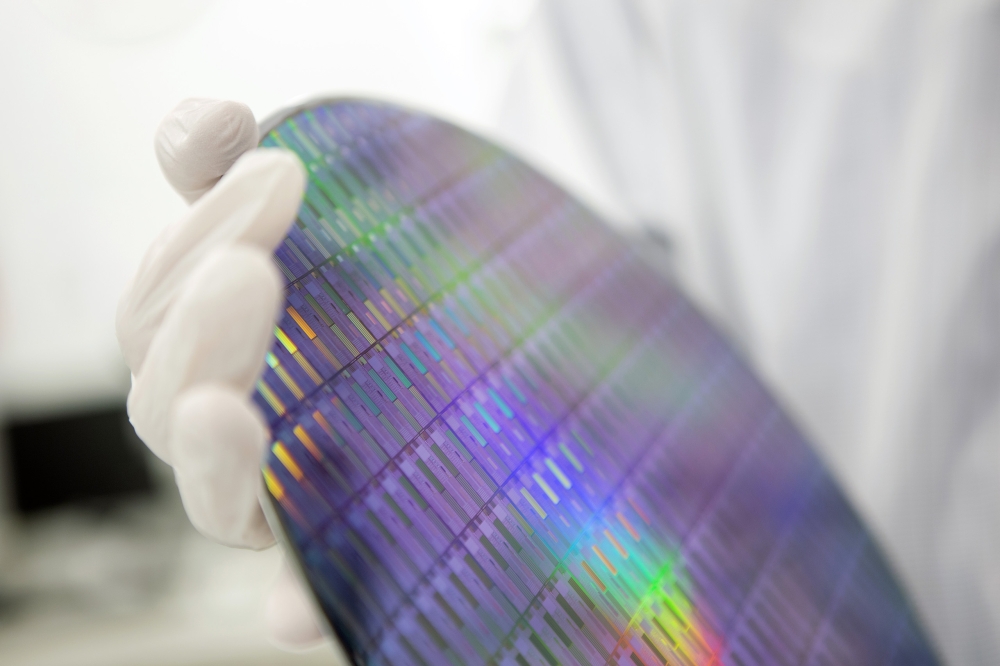

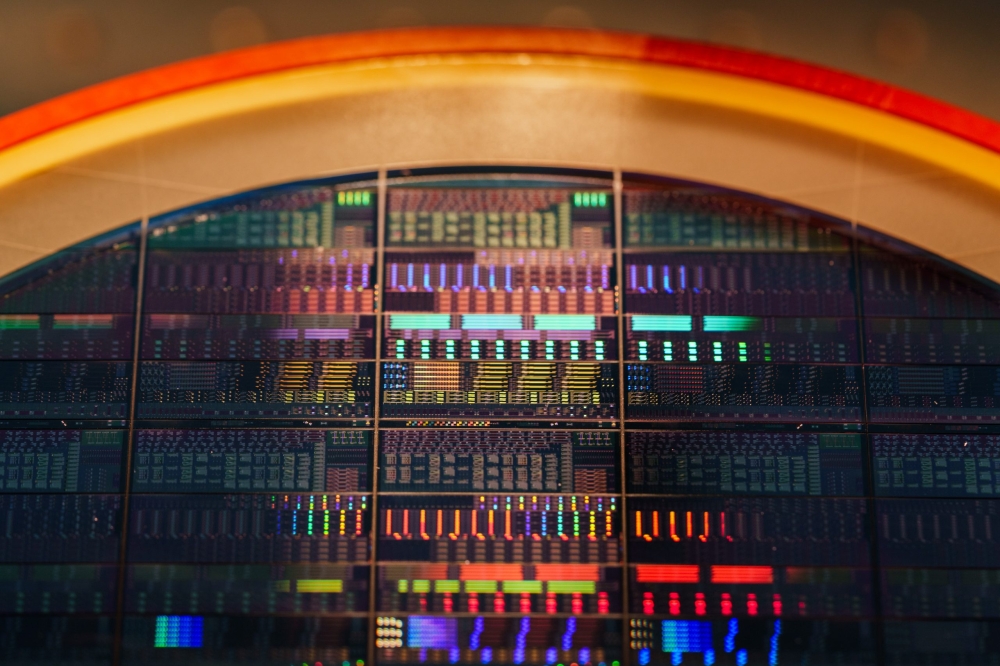

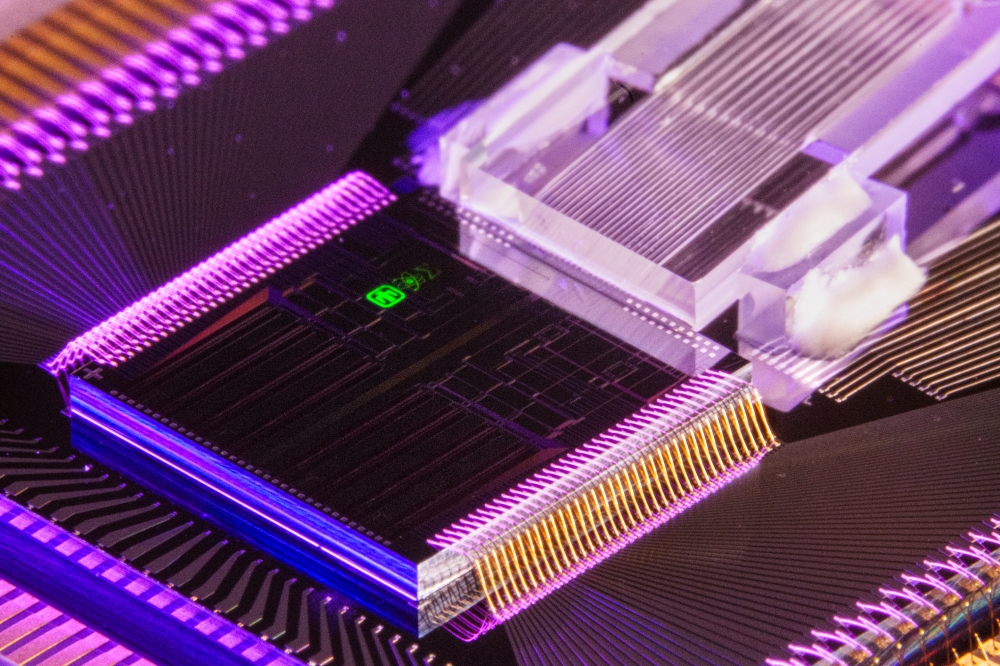

NeoPhotonics, a designer and manufacturer of optoelectronics for communications networks, has begun restructuring to improve profitability and cash flow. The actions include a reduction in workforce, real estate consolidation, a write down of inventory for certain programs and assets and a write-down of idle assets.

These actions are intended to accelerate the company's goal of a return to profitability by implementing specific and sustainable measures designed to lower the company's breakeven revenue levels for profitability and free cash flow, while maintaining the company's focus on its core capabilities, including its industry coherent components and solutions for datacenter interconnect and telecommunications systems.

The company hopes to reduce quarterly operating expenses with immediate impact and achieve an approximately two-million-dollar reduction when fully realised in the first quarter of 2018.The costs to implement these actions are expected to be approximately $4.8 million, with $4.2 million in asset-write off costs and $0.6 million in severance costs. The company expects to incur approximately $4.6 million of these costs in the third quarter with the remainder to be incurred in the fourth quarter.

"Lacking a clear indication of increased demand in China in the third quarter, we initiated several operational changes with the goal of expediting our return to profitability, including implementing certain restructuring initiatives designed to align our business with the current demand environment and lowering manufacturing output to manage inventory levels," said Tim Jenks, xhairman and CEO of NeoPhotonics. "In taking these actions, we have maintained our research and development focus on products for next generation coherent systems, operating at 400 Gigabits/sec to beyond 1 Terabit/sec, wherein our advanced hybrid photonic integration provides the highest value," concluded Jenks.

In addition to these restructuring activities, the company provided preliminary estimated financial results for the third quarter of 2017. Revenue is expected to be in the range of $69 to $71 million, with GAAP gross margin of approximately 10 percent to 13 percent and GAAP loss per share of $0.50 to $0.40, inclusive of restructuring charges.

Excluding restructuring charges, and other regularly excluded items, the company expects non-GAAP gross margin to be in the range of 14 percent to 17 percent and non-GAAP loss per share in the range of $0.35 to $0.27. A reconciliation of the non-GAAP financial measures to the most directly applicable GAAP financial measures is provided at the end of this press release.

These preliminary results compare to a previously provided forecast for third quarter revenue of $70 to $76 million, GAAP gross margin of 23 percent to 26 percent, and GAAP net loss per share of $0.21 to $0.11 and non-GAAP gross margin of 24 percent to 27 percent and non-GAAP loss of $0.17 to $0.07.

In addition to restructuring charges, non-GAAP gross margin and non-GAAP net loss were negatively impacted by the company's decision to reduce production levels during the quarter resulting from a lack of visibility into future demand levels in China. While this reduction impacted overall capacity utilisation and gross margin respectively in the third quarter, the company anticipates these actions will help reduce inventory levels in the fourth quarter.