LIDAR Battle Looms

It is unclear which combination of LIDAR emitter, detector and beam steering technology will lead ten years from now, says IHS Markit

LIDAR semiconductor revenues will reach $1.8 billion in 2026, up from $103 million in 2016, while automotive LIDAR system revenues will reach around $2.5 billion in 2026 from $230 million in 2016. After 2020, the LIDAR market will become increasingly crowded, says Akhilesh Kona, senior analyst for automotive electronics and semiconductors at IHS Markit, with more than 15 suppliers competing over different solutions.

The current generation of automated functions - automatic emergency braking, adaptive cruise control and lane keep assistance - rely largely on cameras, radars and ultrasonic sensors. Each of these devices is limited to different conditions, e.g. weather, object detection, distance, etc. As the complexity of automated driving functions proliferate through L3 to L5, OEMs need to produce more reliable and fail-operational platforms.

Today, LIDAR is a primary choice for redundant sensing in supporting cameras and radars with object recognition, distance estimations and dynamic mapping. In addition, LIDAR offers 3D map localisation and high-resolution cloud-point images serving as a key to the development of automated driving technology.

A technology muddle

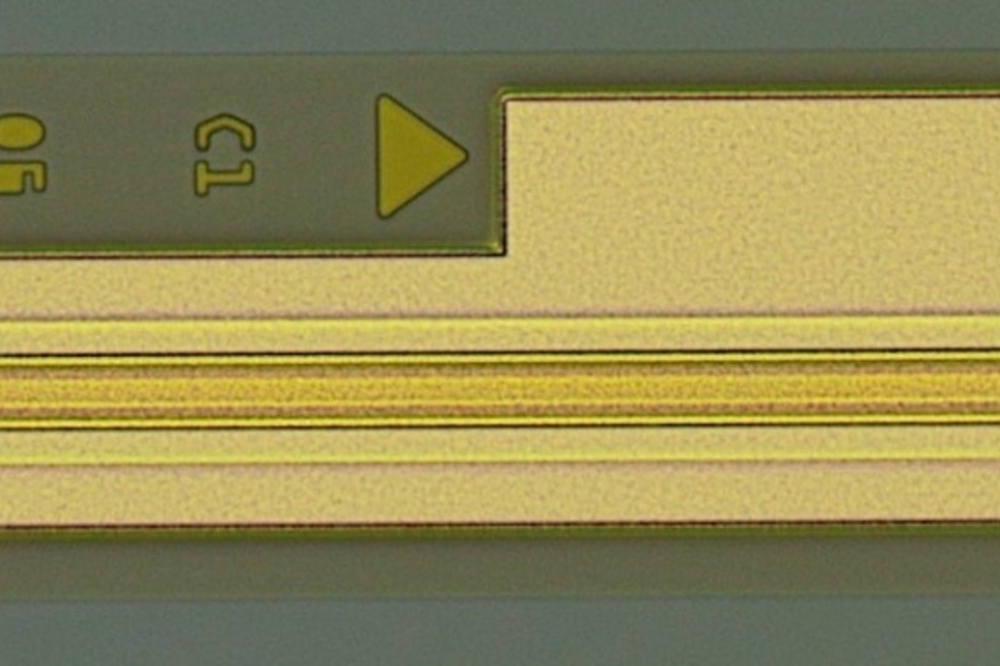

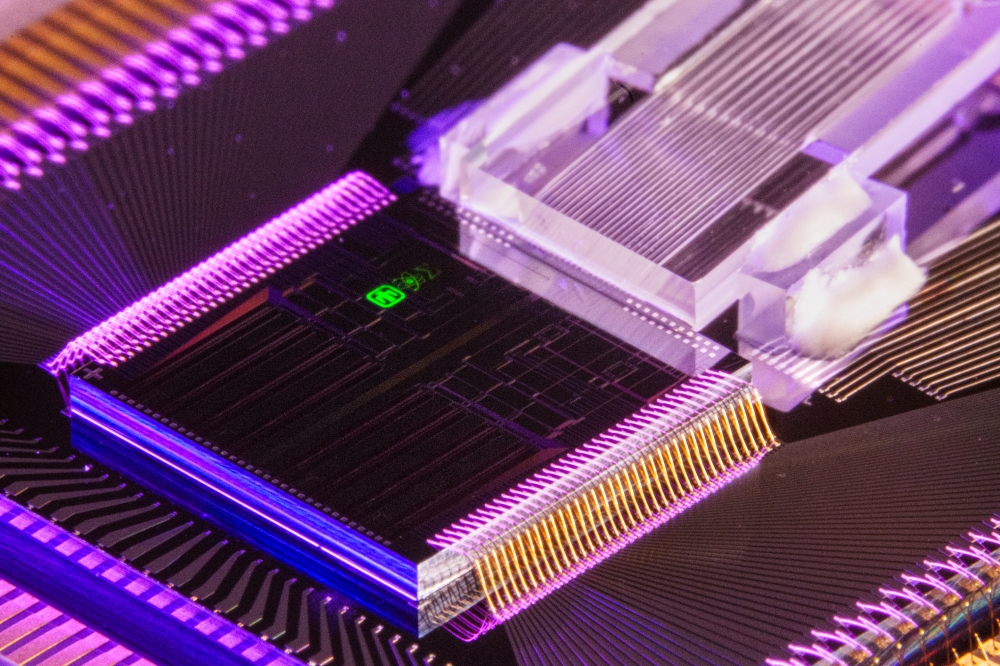

OEMs are currently technology agnostic and aim to roll out automated car platforms around 2020. However, today's commercialised LIDAR technologies do not meet the performance requirements of automated driving, says Kona. Range, low-reflectivity targets, high resolution and eye-safety are some of the key requirements. In addition, today's mechanical scanning LIDARs are vulnerable to shocks, vibration and degradation. Furthermore, its large form factor and high cost restricts its entry into production volumes.

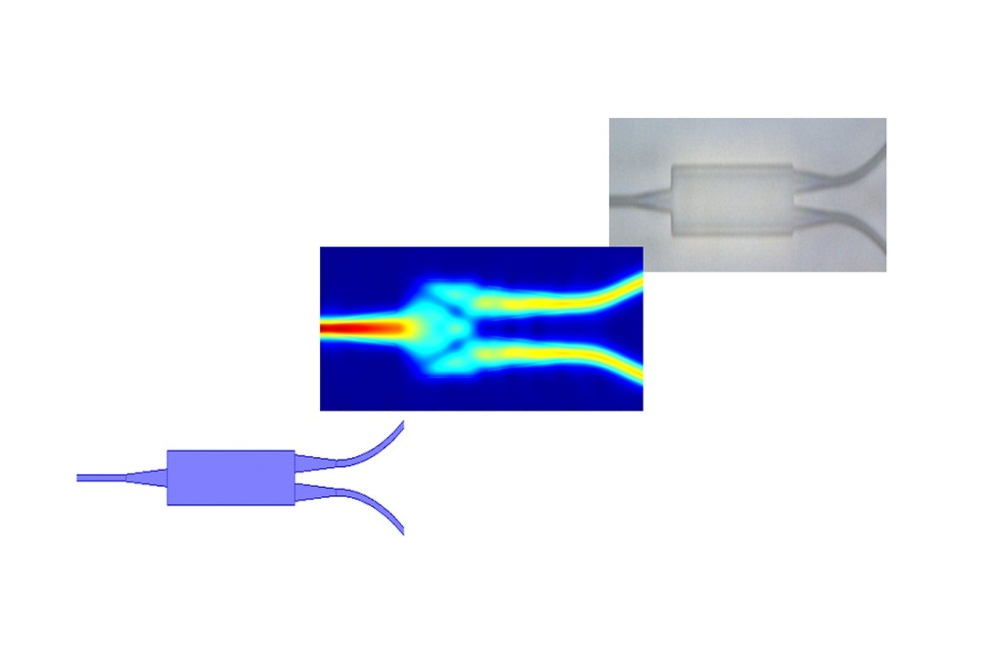

"Clearly a better technology is needed," said Kona. "A battle is now ensuing with solid-state LIDAR technology based on either MEMS or electro-optics or optical phased arrays and high resolution flash devices, all aiming to address the performance requirements of automated driving. Of the promising technologies under development today, each has its advantages and limitations regarding manufacturing, cost, automotive qualification, and other factors."

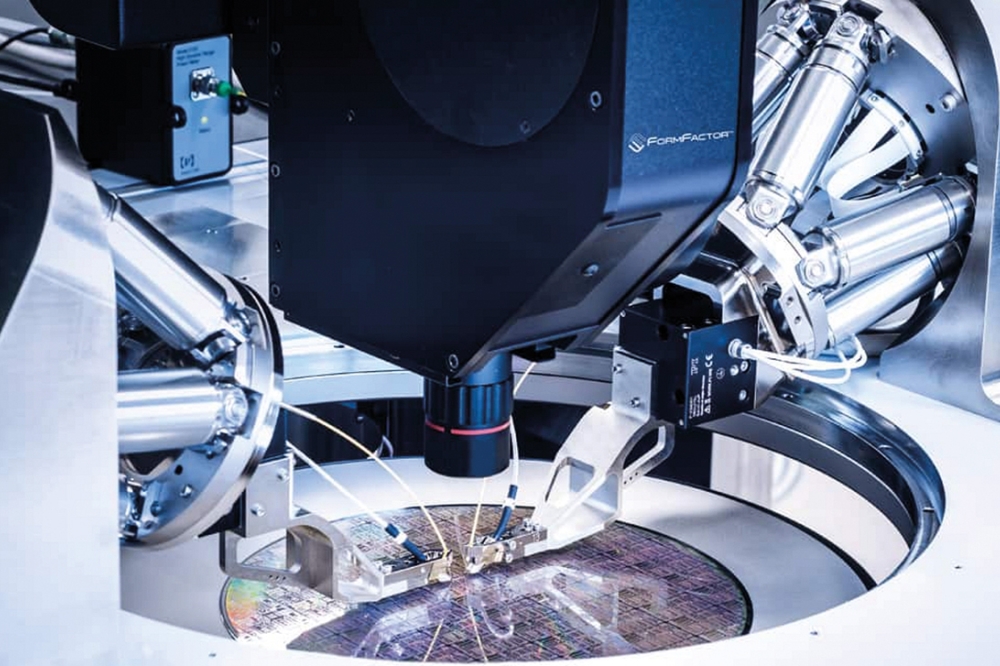

So far, most of the emerging LIDAR suppliers differentiate via in-house design capabilities starting at the semiconductor level, and it is unclear which combination of LIDAR emitter, detector and beam steering technology will lead 10 years from now. IHS Markit has evaluated the LIDAR market and supply chain by four emitter technologies, five detector types and up to 10 beam steering mechanisms.

Supplier landscape

Continental, Valeo, and Denso are the sole suppliers of flash LIDAR solutions today. Velodyne, Valeo, and Ibeo are the major suppliers of mechanical scanning LIDARs. The LIDAR market will become increasingly crowded after 2020 when IHS Markit anticipates that more than 15 suppliers will enter the fray with different solutions.

LIDAR technology is driven mostly by non-automotive optical companies and many start-ups. Business models see partnerships among the traditional Tier-1s and LIDAR suppliers starting to coalesce. Examples of this include Magna and Innoviz Technologies and Infineon's acquisition of Innoluce. Strategic investments include Denso with Trilumina, ZF with Ibeo, Delphi with Quanergy, Delphi and Magna with Innoviz Technologies and many more.

IHS Markit's latest automotive LIDAR market and technology report can be found here.