NeoPhotonics Q2 revenue up 2 percent

Company anticipates robust growth driven by metro networks, datacentre interconnect and 400G

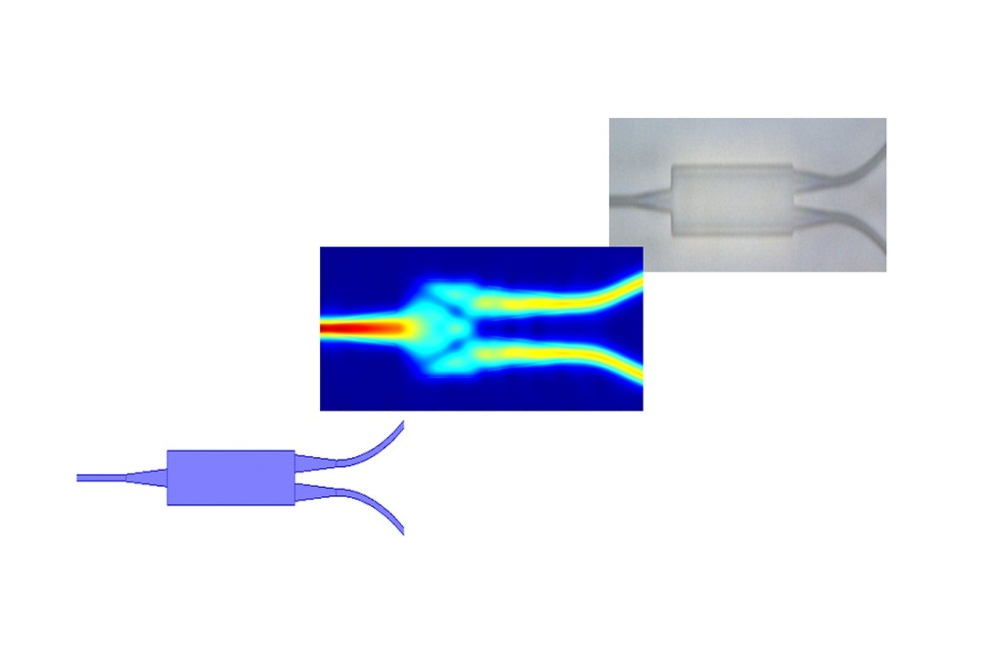

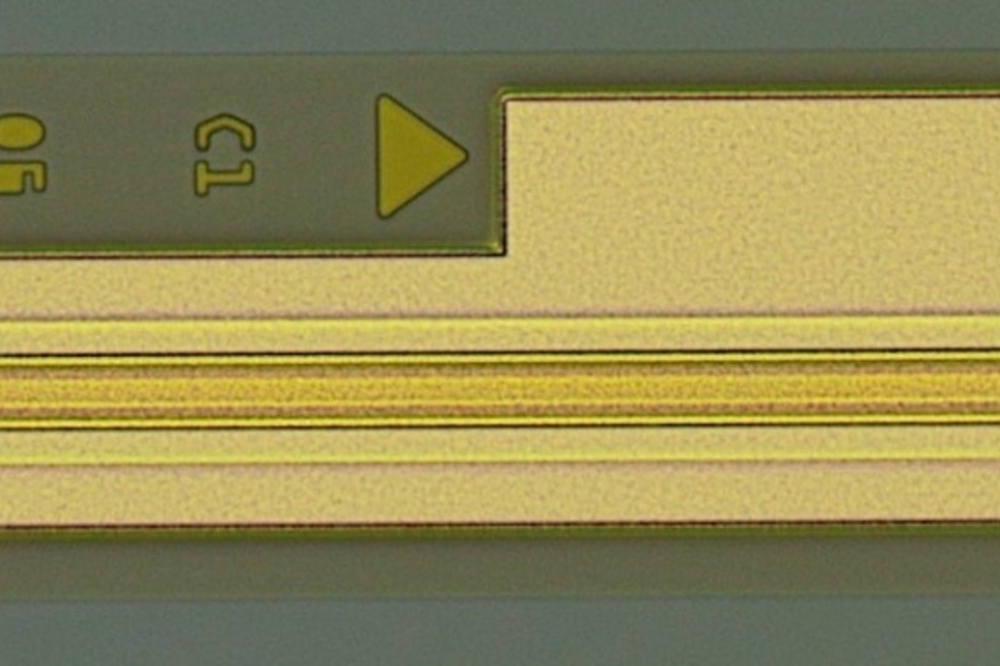

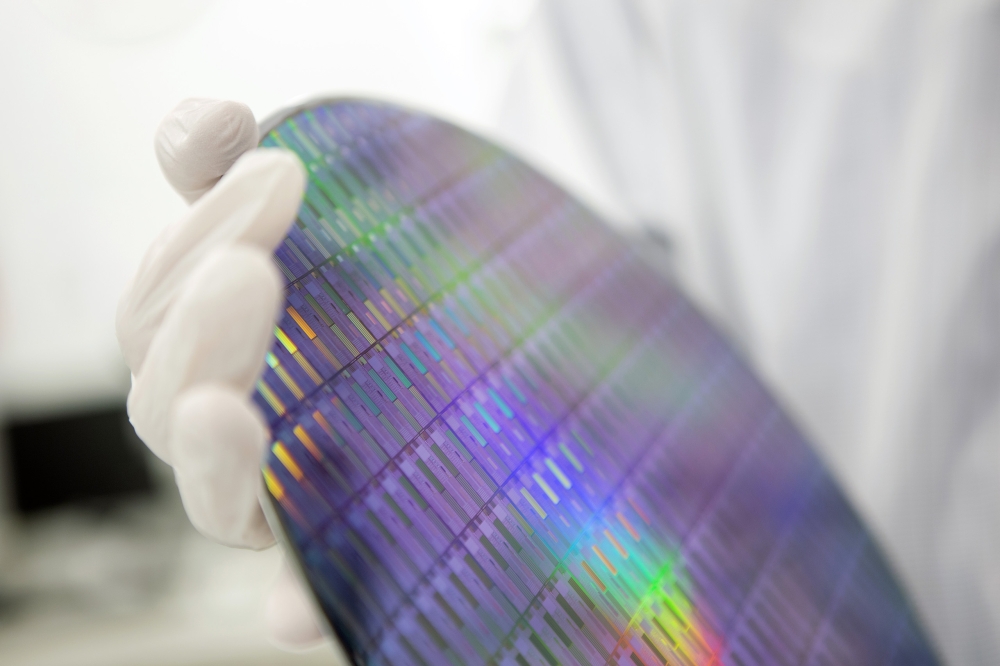

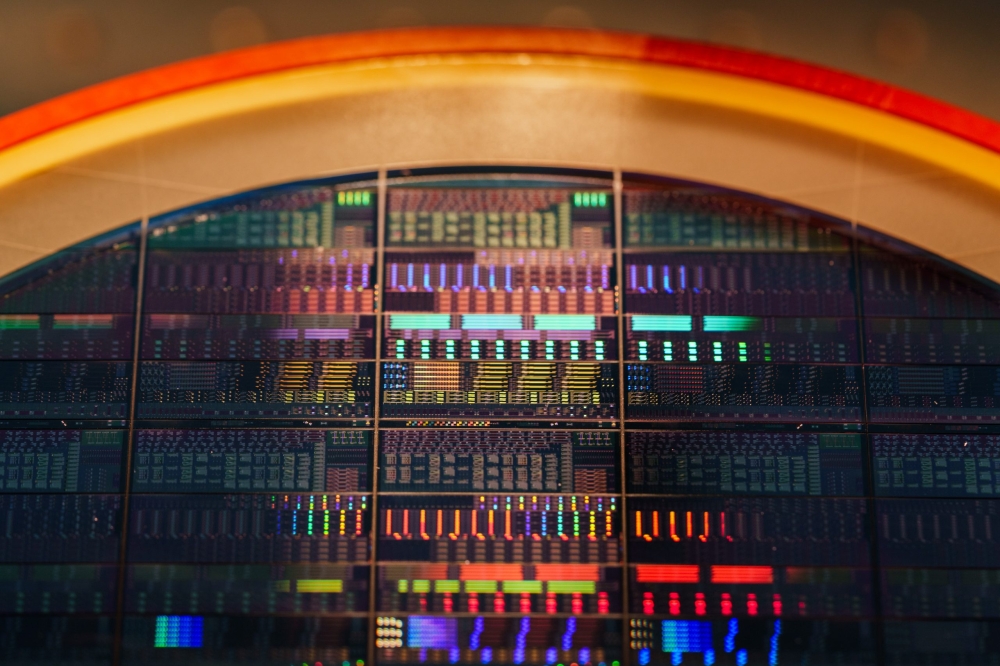

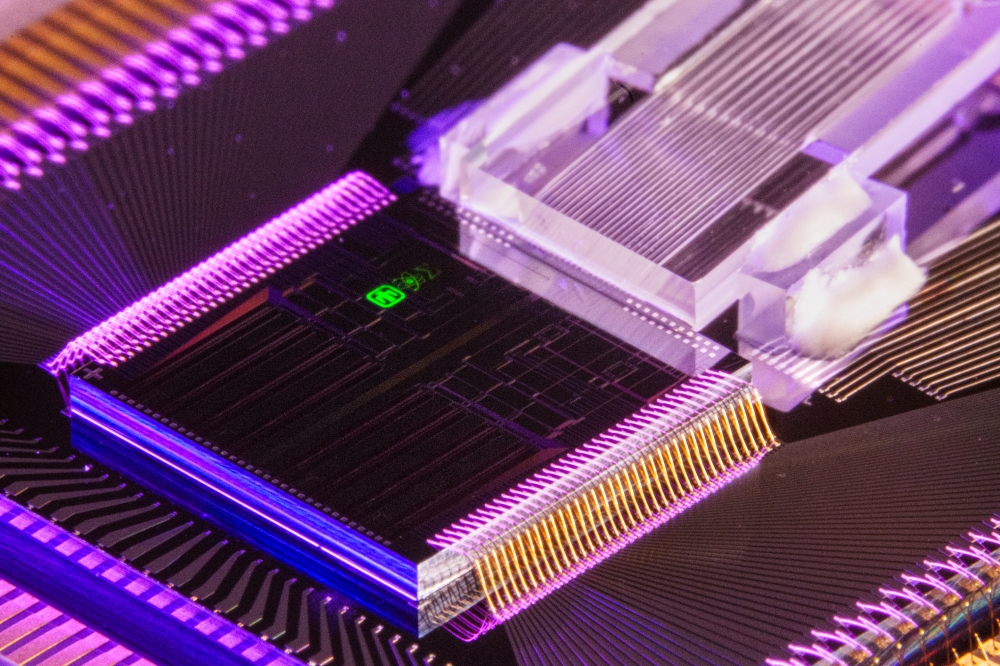

NeoPhotonics, a manufacturer of optoelectronic for high speed communications, has announced its Q2 results (ending June 30, 2017).Overall revenue was $73.2 million, with high speed products contributing 81 percent.

Revenue was up $1.5 million, or 2 percent, from the prior quarter. Gross margin was 22.9 percent, down from 25.8 percent in the prior quarter. Non-GAAP gross margin was 23.9 percent, down from 26.3 percent in the prior quarter.

"We are pleased to report revenue of $73.2 million at the upper end of our previously-announced outlook range and representing sequential growth from the first quarter, including modest sequential growth in China despite an inventory overhang," said Tim Jenks, chairman and CEO of NeoPhotonics.

"While the near term outlook in China isn't certain, we see positive indicators there for the longer-term and we see strong current demand in North America. We anticipate robust growth in the medium and long term driven by metro, datacentre interconnect, a normalised China market and the emergence of 400G and above," conclude Jenks.

Net loss was $9.3 million, an improvement from a net loss of $11.5 million in the prior quarter.Non-GAAP net loss was $6.6 million, an improvement from a net loss of $10.7 million in the prior quarter.

Diluted net loss per share was $0.22, an improvement from a net loss of $0.27 per share in the prior quarter. Non-GAAP Diluted net loss per share was $0.15, an improvement from a net loss of $0.25 in the prior quarter.

Adjusted EBITDA was breakeven, an improvement from a loss of $5.2 million in the prior quarter.

Non-GAAP results in the second quarter of 2017 exclude $0.3 million of amortisation of acquisition-related intangibles, $1.9 million of stock-based compensation expense and $0.7 million of restructuring charges.

As of June 30, 2017, cash and cash equivalents, short-term investments and restricted cash, together totaled $79.0 million, down from $91.5 million at March 31, 2017. Restricted cash as of June 30, 2017 was $3.3 million, down from $3.7 million at March 31, 2017.

Outlook for Q3 is shown in the table below.

The Non-GAAP outlook for the third quarter of 2017 excludes the impact of expected amortisation of intangibles of approximately $0.3 million and the anticipated impact of stock-based compensation of approximately $1.8 million, of which $0.3 million is estimated for cost of goods sold.