Quality problems adversely affect Acacia Q2 results

Company remains confident that growth strategy is on track

Acacia Communications, a provider of high-speed coherent optical interconnect products, has reported Q2 revenue of $78.9 million down 32 percent year-over-year.

"As we previously announced, our second quarter results were adversely affected by the quality issue identified at one of our three contract manufacturers," said Raj Shanmugaraj, president and CEO.

GAAP gross margin was 32.2 percent; non-GAAP gross margin* was 42.7 percent. GAAP loss from operations was $(6.7) million and non-GAAP income from operations* was $7.3 million. GAAP net income was $4.7 million and non-GAAP net income* was $10.8 million.

EBITDA was $(3.7) million and adjusted EBITDA was $10.2 million. GAAP diluted EPS was $0.11 and non-GAAP diluted EPS* was $0.26.

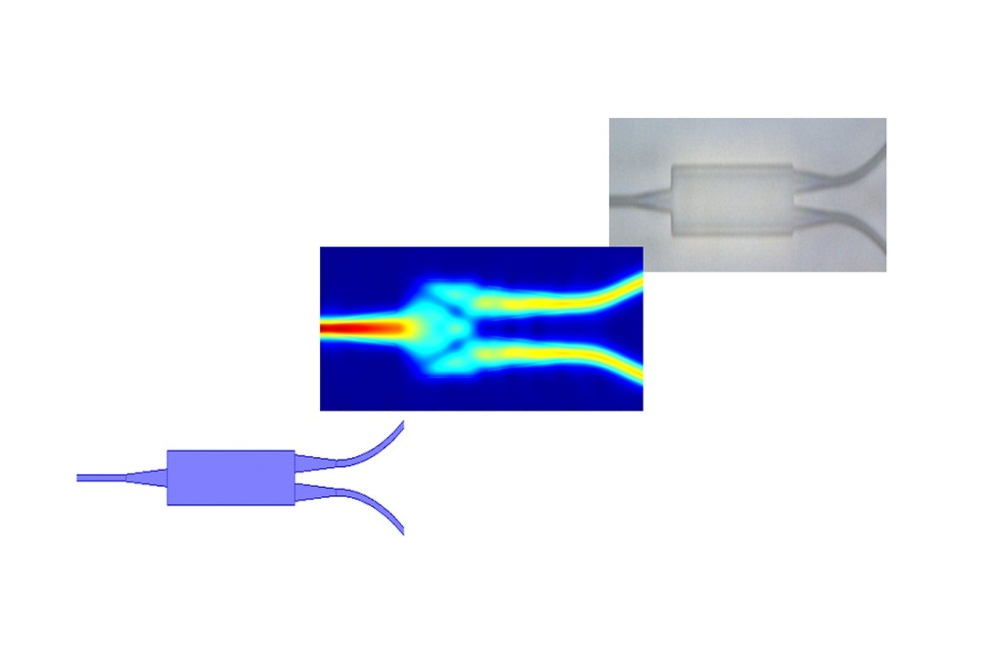

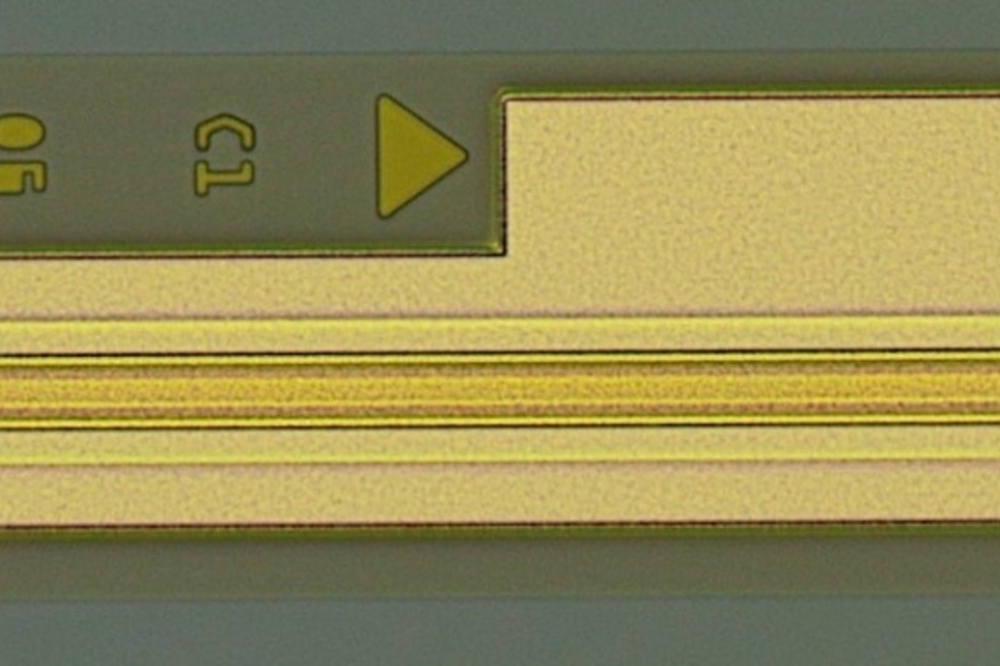

"Looking forward, we are seeing improving order rates in the third quarter from some of our key customers, including our largest customer in China, and customers in the metro and DCI markets," said Shanmugaraj. "We are also pleased with the traction we are seeing with our new products, especially our "industry first" CFP2-DCO module and our in development Pico-based 1.2 Tbps solution. We remain confident that our growth strategy is on track."

"Despite a challenging second quarter, we believe we are well positioned to meet customer demand for our products in the third quarter," said John Gavin, CFO of Acacia Communications. "Further, we believe that our talented employees, business model, market strategy, strength of our balance sheet and differentiated products position us for future growth."

Outlook for Q3 of 2017

Acacia Communications' guidance for its third quarter ending September 30, 2017 is revenue $95 million to $110 million; non-GAAP bet income of $10 million to $16 million, and non-GAAP diluted earnings per share of $0.25 to $0.40.