Promising European Photonics Results Are In

2017 market studies show outstanding success of key technology

New research, released to coincide with LaserWorld Munich 2017, shows that the global photonics market grew from €228 billion in 2005 to €447 billion in 2015. With a long-term growth rate averaging 7 percent annually, this beats the growth of the worldwide gross domestic product by factor of almost two. The market grew at a compound annual growth rate (CAGR) of 6.2% during the last four years (2011 "“ 2015). That growth rate is calculated on a Euro basis. Currency effects had a strong impact on growth rates.

PhotonDelta's Jonathan Marks has been cherrypicking from the two new research publications commissioned from Optech Switzerland by the German VDMA Photonics Forum and the European Technology Platform Photonics21.

Leading global market position in core areas

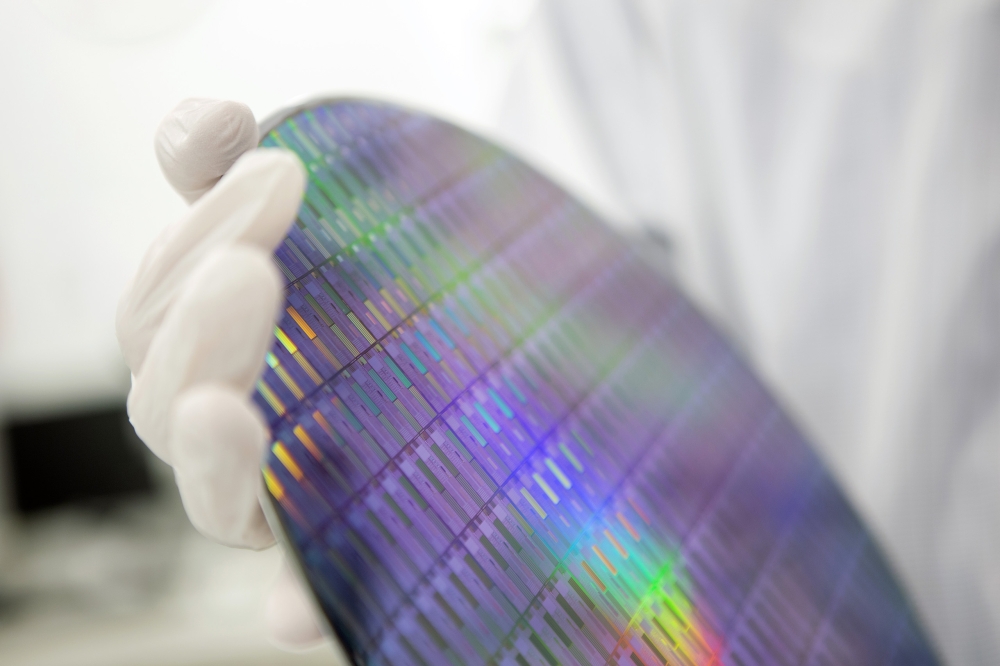

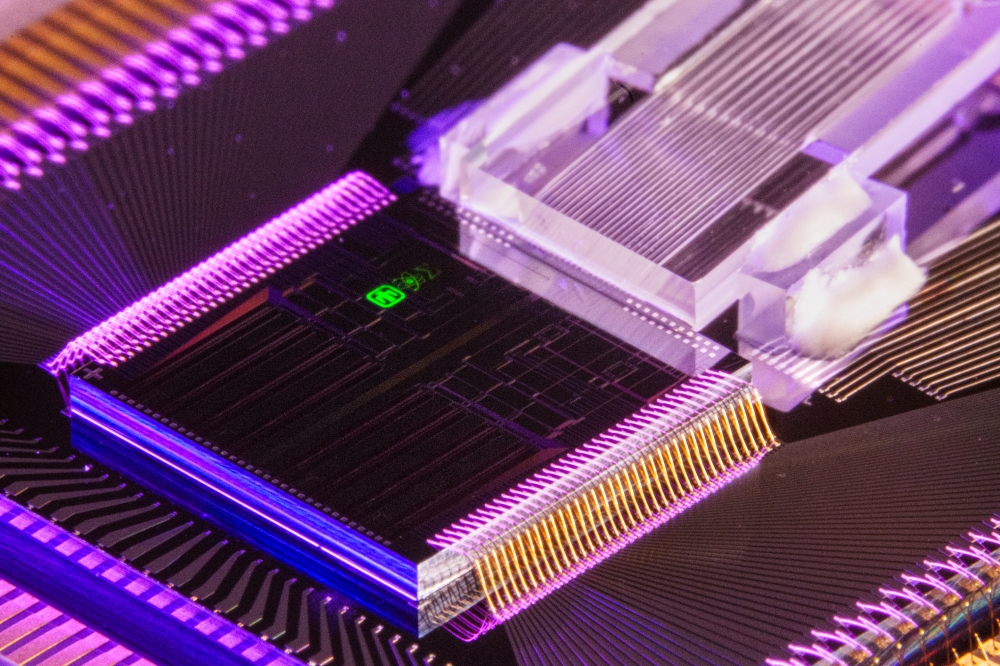

The European photonics industry was able to maintain its leading market position in the core areas of production technology (laser material processing, lithography), image processing and measurement technology, as well as medical technology and life sciences. The relevant drivers are the increased automation and flexibility of manufacturing as well as implementation of digitalization concepts as part of Industry 4.0.

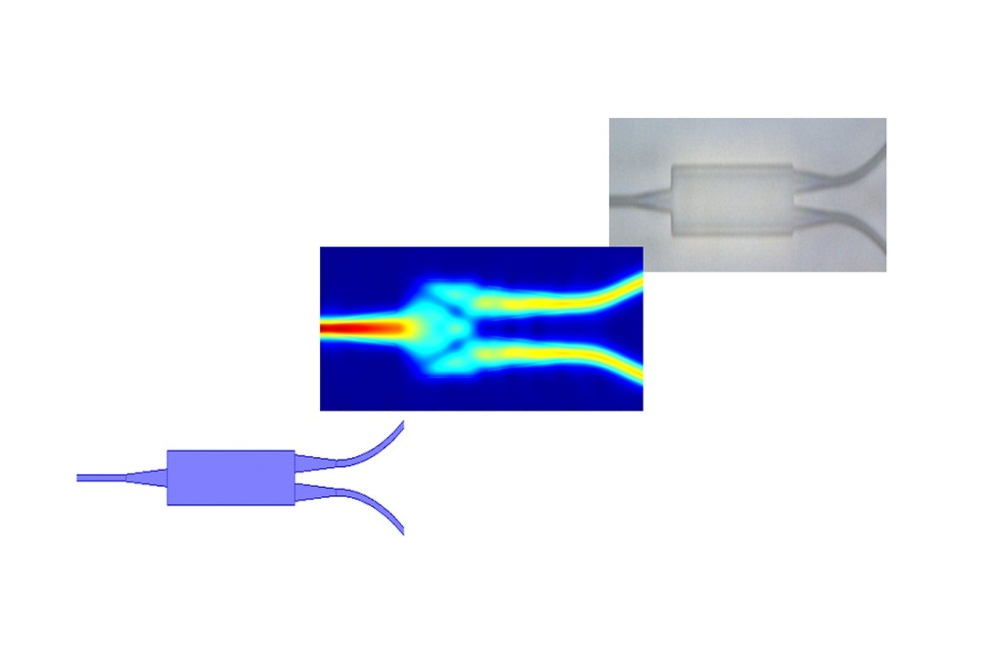

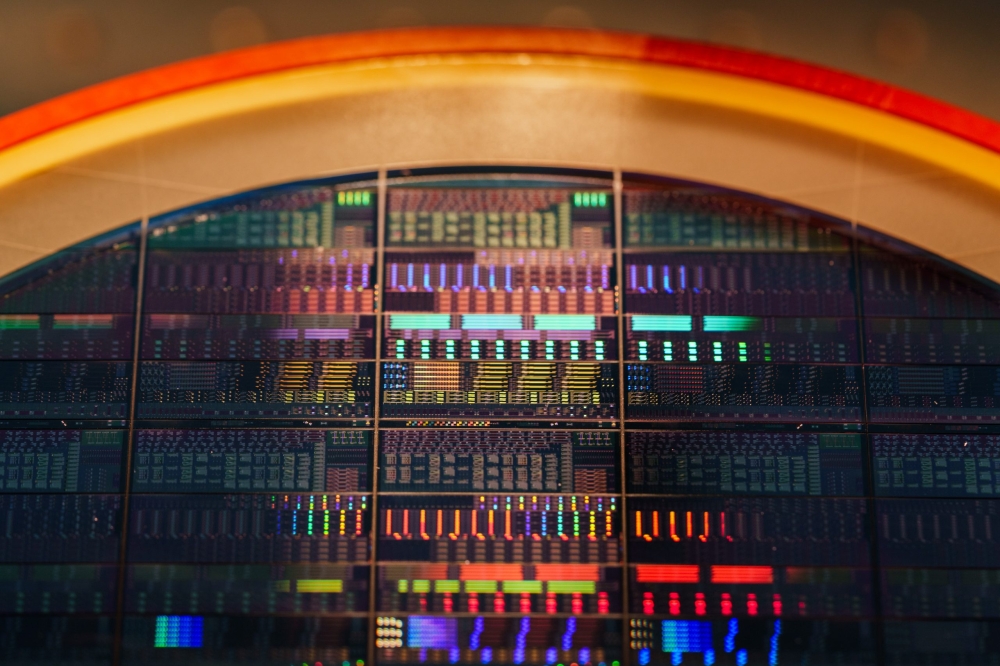

Integrated Photonics is already playing an important role in 7 of the 10 sectors shown above: the exceptions being Displays, Lighting and Photovoltaics (Solar cells & related products). For comparison: the share of nano and microelectronics technology in the total electronics market is about 15%. So, the market for PICs is still expected to be a multi-billion dollar share of the total Photonics market.

China becomes global market leader, Europe takes second place

Shares in the global photonics market have shifted strongly in recent years. In 2015, China displaced the longstanding global market leader Japan with a 26.6 percent share of production. The countries were still tied in 2011 each with 21.3 percent. With a market share of 15.5 percent, Europe nudged out Japan (15.4 percent) to become the second-largest photonics producers. North America, which lost more than 4 percent of the global market share between 2005 and 2011, has increased its market share to 13.6 percent in recent years.

Employment

Altogether, there are 301,000 people who work directly in the European photonics industry, as substantiated by the study from Photonics21. If the photovoltaics segment is left out, 55,000 new jobs have been created in Europe since 2005 despite the financial crisis in the interim. The study from Photonics21 expects continuous job growth up to 313,000 employees by the year 2020.

- The global market for Photonics products in 2015 accounted for € 447 billion.

- The production volume of the European Photonics industry accounted for € 69.2 billion in 2015, corresponding to a global market share of 15.5%2. Since 2011 the production volume of the European Photonics industry has grown from € 65.6 billion to € 69.2 billion, corresponding to a CAGR of 1.3%. These figures include the European photovoltaic industry which shrank by two third during the here assessed 2011 to 2015 period due to harsh price competition from China. If you exclude photovoltaics, the 2015 European Photonics production volume accounted for € 66.6 billion, corresponding to a 17.0% share in the world market (€391 billion). The production volume of the European Photonics industry without photovoltaics grew from € 57.1 billion in 2011 to € 66.6 billion in 2015, corresponding to a CAGR of 3.9%.

Those Ten Segments in Detail:

Photonics products are used in a wide range of sectors, similar to electronics products. The applications and products can be summarized in ten segments.

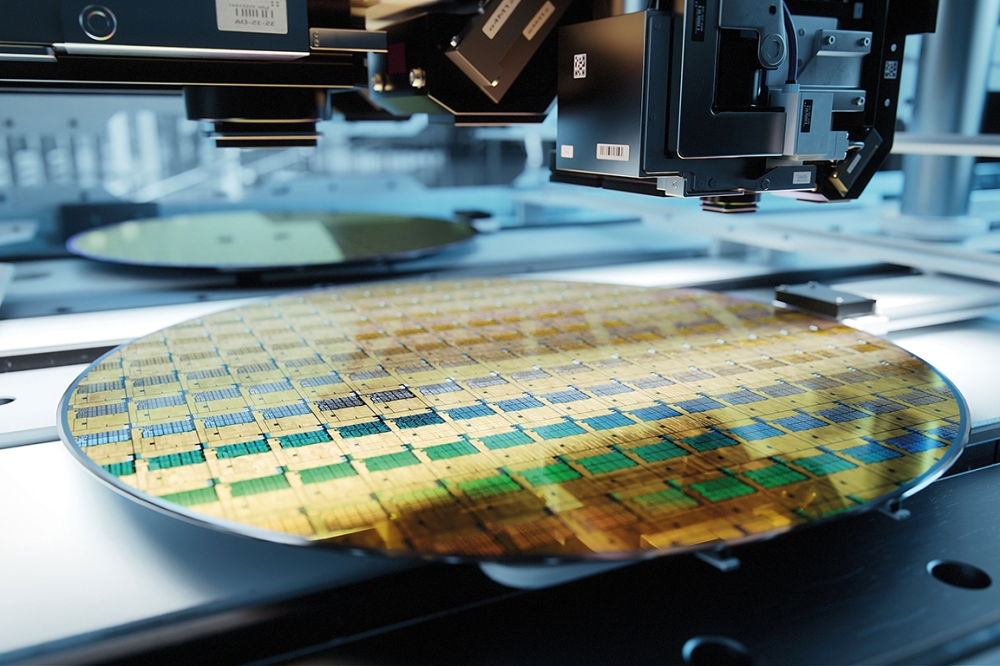

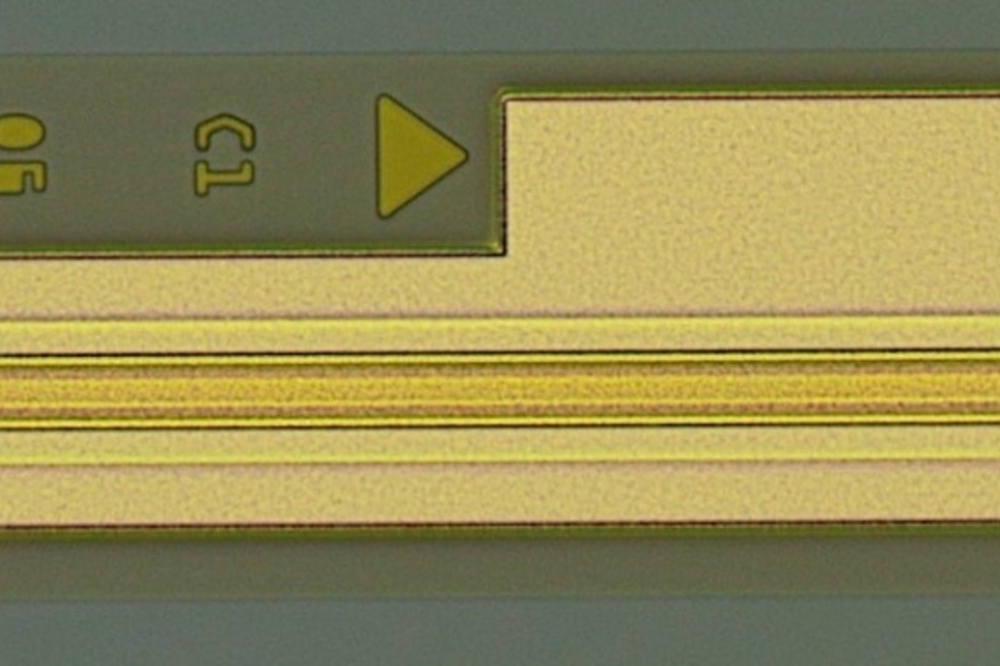

In the first segment, production technology, which includes equipment for laser materials processing as well as lithographic manufacturing processes, Europe has an especially large footprint with 50% of all products worldwide originating from Europe. The products of that segment are used for industrial manufacturing.

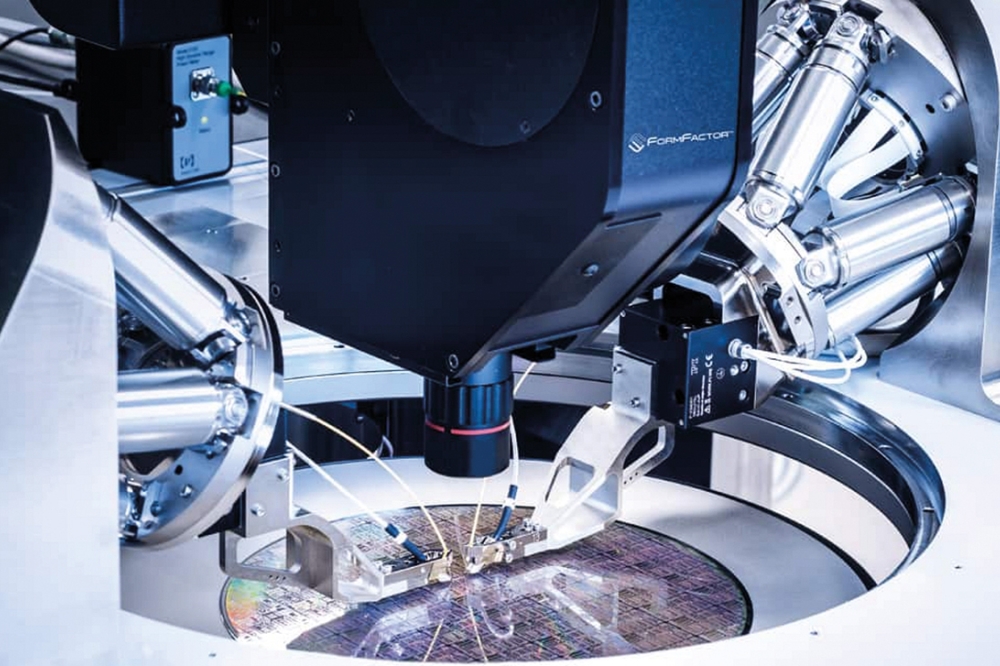

Also the products of the second segment, optical measurement & image processing, are mainly used in industrial manufacturing. In this segment Europe makes 35% of all products, worldwide. The two segments combined account for a 2015 production volume in Europe of approx. € 25 billion corresponding to 36% of the European Photonics production.

The third segment, Photonics based medical technology & life science, accounts for a European production volume of € 9.6 billion or 14% of the total European Photonics production. 28% of all products worldwide originate from Europe.

The products in the next three segments deal with data transmission, input, output, storage, and display. When combined. the three segments account for about 12% of the European Photonics production.

The segment of optical communication or optical networking comprises a European production volume of €4.1 billion or 6% of European Photonics. The global market share of the European production is 18%.

The segment of Photonics based information technology, mainly comprising consumer electronics and office automation products, accounts for a European production volume of € 2.4 billion, corresponding to about 3.5% of European Photonics and 3% of the global market.

The segment of flat panel displays and display materials accounts for a European production volume of € 1.7 billion or about 2.5% of European Photonics. The share in the global market is about 1.5%.

Lighting accounts for an European production volume of € 8.3 billion or 12% of European Photonics. The share of the European production in the global market is 25%.

Defence & security Photonics makes up for a European production volume of € 7.9 billion or 11% of European Photonics, and for a share in the global market of 26%.

Optical components & systems account for a production volume in Europe of € 7.8 billion or 11% of European Photonics and for a share of 32% in the global market.

Finally, Photovoltaics makes up for 4% of European Photonics, after shrinking from revenues of € 8.5 billion in 2011 to only € 2.6 billion in 2015. Now, it only represents 5% of the global production versus 17% in 2011.

Reasons for growth

European companies are well represented in the global market, with market shares mostly between 25% and 50%. The only exception are the data- related segments (information, communication, display) where the European Photonics industry only holds a 4% share in the world market. The small share is due to a very small European footprint in the large segments of flat panel displays, consumer electronics and office automation products. Optical communication is the only data-related segment where the European industry with a global share of 18% has a major presence.

In Europe, manufacturing - oriented Photonics products are the most important focus, making up a 36% share of total Photonics production.

European industry holds substantial market shares in laser materials processing and lithography (50% share of the world market mainly due to ASML in the Netherlands) as well as in measurement and image processing (35%). Other important sectors of European Photonics comprise medical technology & life science (28% share of the world market), optical components and systems (32%), lighting (25%), and defence & security (26%). In photovoltaics, the European market share was down to less than 5% in 2015, from 17% in 2011 and from 35% in 2005.

Since 2011 the European Photonics industry grew in segments where it already commands a large global market share. Strong growth was observed in the manufacturing oriented sectors of production technology (2011 to 2015 CAGR 4.9%) and measurement & image processing (5.7%). The growth in production technology is due to laser materials processing (10.8%) while the production volume in lithography sub-segment only grew slightly due to the delay of the Extreme Ultra-Violet technologies for producing advanced integrated circuits technology.

The production in medical technology & life science grew strongly (5.3%).

The European production volume in lighting grew at a CAGR of 3.7%. European manufacturers increased their sales amidst the transition of the sector to solid state lighting. The weakening Euro helped to achieve growth for the European lighting industry, while at the same time it also led to market share losses. Defence & security (CAGR 3.0%) suffered from the stagnating defence spending of European governments.

Growth in the segment of optical components & systems was only 1.2% (CAGR), down from 7.0% for the years 2005 to 2011. The decrease is due to slowing growth in major user segments, besides a partial production shift from Europe to Asia. In the remaining segments, the European Photonics industry was successful in niches, such as for flat panel display materials and high end digital cameras. Here, the success is due to good positioning of single companies. In photovoltaics, the European production volume shrank dramatically from 2011 to 2015 (CAGR of -26%).

Germany First, The Netherlands second in production.

By country, Germany is the largest producer of Photonics in Europe with a share of 41.3%. Germany is the major European producer in all Photonics segments except production technology, where the Netherlands lead, and defence & security, where the United Kingdom and France lead. The Netherlands with a share of 12.5% is the second largest Photonics producer in Europe. The country is home to the European company with the largest production volume, ASML in Velthoven. France follows in third place with a share of 11.6%, ahead of the United Kingdom with a share of 9.9% and Italy with a 8.3% share. The other EU28 countries account for a combined share of 12.8%. Switzerland accounts for a 3.6% share, while other non-EU countries in Europe combined only have a very small share.